For the years ended December 31, 2011, 2010 and 2009. Amounts expressed in millions of U.S. dollars ($) and in millions of Mexican pesos (Ps.).

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 |

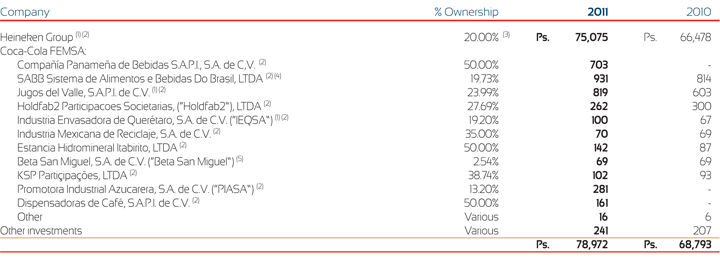

9 Investments in Shares

(1) The Company has significant influence due to the fact of its representation in the Board of Directors in those companies.

(2) Equity method. The date of the financial statements of the investees used to account for the equity method is the same as the one used in the Company consolidated financial statements.

(3) As of December 31, 2011 , comprised of 12.53% of Heineken, N.V. and 14.94% of Heineken Holding, N.V., which represents an economic interest of 20% in Heineken (see Note 5 B).

(4) During June 2011, a reorganization of the Coca-Cola FEMSA Brazilian investments occurred by way of a merger of the companies Sucos del Valle Do Brasil, LTDA and Mais Industria de Alimentos, LTDA giving rise to a new company by the name of Sistema de Alimentos e Bebidas do Brasil, LTDA.

(5) Acquisition cost.

On March 28, 2011 Coca-Cola FEMSA made an initial investment for Ps. 620 together with The Coca-Cola Company in Compañía Panameña de Bebidas S.A.P.I. de C.V. (Grupo Estrella Azul), a Panamanian conglomerate in the dairy and juice-based beverage categories business in Panama. The investment of Coca-Cola FEMSA represents 50% of ownership .

In August 2010, Coca-Cola FEMSA made an investment for approximately Ps. 295 (40 Brazilian Reai million) in Holdfab2 Participações Societárias, LTDA representing a 27.69% interest. Holdfab2 has a 50% investment in Leao Junior, a tea producer company in Brazil.

During 2010, the shareholders of Jugos del Valle, including Coca-Cola FEMSA, agreed to spin-off the distribution rights. Those shareholders now purchase product directly from Jugos del Valle for resale to their customers. This reorganization resulted in a decrease of Coca-Cola FEMSA's investment in shares of Ps. 735 and an increase to its intangible assets (distribution rights of a separate legal entity) for the same amount. During 2011, Coca-Cola FEMSA increased its ownership percentage in Jugos del Valle from 19.80% to 23.99% as a result of the holdings of the acquired companies disclosed in Note 5.

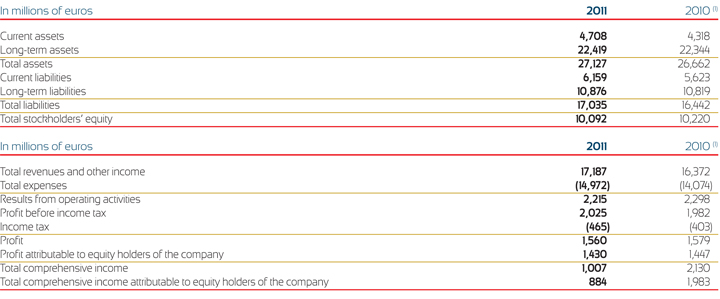

Heineken's main activities are the production, distribution and marketing of beer worldwide. The Company recognized an equity income of Ps. 5,080 and Ps. 3,319 regarding its interest in Heineken, for the year ended December 31, 2011 and the period from May 1, 2010 to December 31, 2010, respectively.

The following is some relevant financial information from Heineken as of December 31, 2011 and 2010 and the consolidated results for the full years as of December 31, 2011 and 2010:

(1) Heineken adjusted its comparative figures due to the accounting policy change in employee benefits.

As of December 31, 2011 and 2010 fair value of Company's investment in Heineken N.V. Holding and Heineken N.V. represented by shares equivalent to 20% of its outstanding shares amounted to € 3,942 and € 4,048 based on quoted market prices of those dates. As of March 12, 2012, issuance date of these consolidated financial statements, fair value amounted to € 4,469.

During the years ended December 31, 2011 and 2010, the Company has received dividends distributions from Heineken, amounted to Ps. 1,661 and Ps. 1,304, respectively.