For the years ended December 31, 2011, 2010 and 2009. Amounts expressed in millions of U.S. dollars ($) and in millions of Mexican pesos (Ps.).

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 |

4 Significant Accounting Policies

The Company's accounting policies are in accordance with Mexican FRS, which require that the Company's management make certain estimates and use certain assumptions to determine the valuation of various items included in the consolidated financial statements. The Company's management believes that the estimates and assumptions used were appropriate as of the date of these consolidated financial statements. However actual results are subject to future events and uncertainties, which could materially impact the Company's actual performance.

The significant accounting policies are as follows:

a) Recognition of the Effects of Inflation in Countries with Inflationary Economic Environment:

NIF B-10 establishes two types of inflationary environments: a) inflationary economic environment; this is when cumulative inflation of the three preceding years is 26% or more. In such case, inflation effects are recognized in the financial statements by applying the integral method and the recognized restatement effects for inflationary economic environments is made starting in the period that the entity becomes inflationary; and b) non-inflationary economic environment; this is when cumulative inflation of the three preceding years is less than 26%. In such case, no inflationary effects are recognized in the financial statements, keeping the recognized restatement effects from the last period in which the inflationary accounting was applied.

The Company recognizes the effects of inflation in the financial information of its subsidiaries that operate in inflationary economic environments through the integral method, which consists of:

- Using inflation factors to restate non-monetary assets such as inventories, investments in process, property, plant and equipment, intangible assets, including related costs and expenses when such assets are consumed or depreciated. The imported assets are recorded using the exchange rate of the acquisition date, and are restated using the inflation factors of the country where the asset is acquired for inflationary economic environments;

- Applying the appropriate inflation factors to restate capital stock, additional paid-in capital, retained earnings and the cumulative other comprehensive income/loss by the necessary amount to maintain the purchasing power equivalent in Mexican pesos on the dates such capital was contributed or income was generated up to the date these consolidated financial statements are presented; and

- Including in the Comprehensive Financing Result the gain or loss on monetary position (see Note 4 T).

The operations of the Company are classified as follows considering the cumulative inflation of the three preceding years of 2011. The following classification was also applied for the 2010 period:

(1) Costa Rica and Nicaragua have been considered inflationary economies in 2009, 2010 and 2011. While the cumulative inflation for 2008-2010 was less than 26%, inflationary trends in these countries continue to support this classification.

b) Cash and Cash Equivalents and Investments:

Cash and Cash Equivalents:

Cash is measured at nominal value and consists of non-interest bearing bank deposits and restricted cash. Cash equivalents consisting principally of short-term bank deposits and fixed-rate investments with original maturities of three months or less are recorded at its acquisition cost plus accrued interest income not yet received, which is similar to listed market prices.

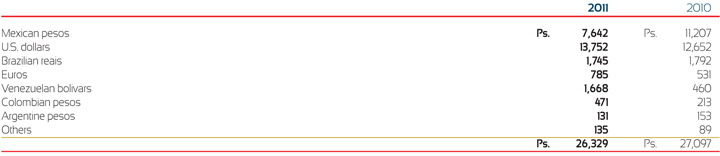

As of December 31, 2011 and 2010, the Company has restricted cash which is pledged as collateral of accounts payable in different currencies as follows:

As of December 31, 2011 and 2010, cash equivalents amounted to Ps. 17,908 and Ps. 19,770, respectively.

Investments:

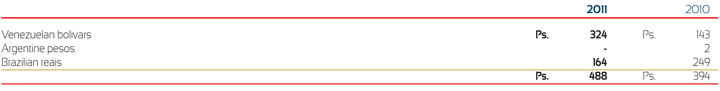

Investments consist of debt securities and bank deposits with maturities more than three months. Management determines the appropriate classification of investments of the time of purchase and reevaluates such designation as of each balance date. As of December 31, 2011 and 2010 investments are classified as available-for-sale and held-to maturity.

Available-for-sale investments are carried at fair value, with the unrealized gains and losses, net of tax, reported in other comprehensive income. Interest and dividends on investments classified as available-for-sale are included in interest income. The fair values of the investments are readily available based on quoted market prices.

Held-to maturity investments are those that the Company has the positive intent and ability to hold to maturity, and are carried at acquisition cost which includes any cost of purchase and premium or discount related to the investment which is amortized over the life of the investment based on its outstanding balance. Interest and dividends on investments classified as held-to maturity are included in interest income. The carrying value of Held-to maturity investments is similar to its fair value. The following is a detail of available-for-sale and held-to maturity investments.

(1) Investments contracted in euros at a fixed interest rate and maturing on April 2, 2012.

c) Accounts Receivable:

Accounts receivable representing exigible rights arising from sales, services and loans to employees or any other similar concept, are measured at their realizable value and are presented net of discounts and allowance for doubtful accounts.

Allowance for doubtful accounts is based on an evaluation of the aging of the receivable portfolio and the economic situation of the Company's clients, as well as the Company's historical loss rate on receivables and the economic environment in which the Company operates. The carrying value of accounts receivable approximates its fair value as of both December 31, 2011 and 2010.

Coca-Cola FEMSA has accounts receivable from The Coca-Cola Company arising from the latter's participation in advertising and promotional programs and investment in refrigeration equipment and returnable bottles made by Coca-Cola FEMSA (see Note 4 L).

d) Inventories and Cost of Sales:

Inventories are measured at the lower of cost or net realizable value.

The cost of inventories is based on the weighted average cost formula and the operating segments of the Company use inventory costing methodologies to value their inventories, such as the standard cost method in Coca-Cola FEMSA and retail method in FEMSA Comercio.

Cost of sales based on average cost is determined based on the average amount of the inventories at the time of sale. Cost of sales includes expenses related to raw materials used in the production process, labor cost (wages and other benefits), depreciation of production facilities, equipment and other costs such as fuel, electricity, breakage of returnable bottles in the production process, equipment maintenance, inspection and plant transfer costs.

e) Other Current Assets:

Other current assets are comprised of payments for goods and services whose inherent risks and benefits have not been transferred to the Company and that will be received over the next 12 months, the fair market value of derivative financial instruments with maturity dates of less than one year (see Note 4 U), and long-lived assets available for sale that will be sold within the following year.

Prepaid expenses principally consist of advances to suppliers of raw materials, advertising, promotional, leasing and insurance expenses, and are recognized in the appropriate balance sheet or income statement caption when the risks and benefits have already been transferred to the Company and/or goods, services or benefits are received.

Advertising costs consist of television and radio advertising airtime paid in advance, and is generally amortized over a 12-month period based on the transmission of the television and radio spots. The related production costs are recognized in income from operations the first time the advertising is broadcasted.

Promotional expenses are recognized as incurred, except for those promotional costs related to the launching of new products or presentations before they are on the market. These costs are recorded as prepaid expenses and amortized over the period during which they are estimated to increase sales of the related products or container presentations to normal operating levels, which is generally no longer than one year.

The long-lived assets available-for-sale are recorded at the lower of cost or net realizable value. Long-lived assets are subject to impairment tests (see Note 8).

f) Capitalization of Comprehensive Financing Result:

Comprehensive financing result directly attributable to qualifying assets has to be capitalized as part of acquisition cost, except for interest income obtained from temporary investments while the entity is waiting to invest in the qualifying asset. Comprehensive financing result of long-term financing clearly linked to qualifying assets is capitalized directly. When comprehensive financing result of direct or indirect financing is not clearly linked to qualifying assets, the Company capitalizes the proportional comprehensive financing result attributable to those qualifying assets by the weighted average interest rate of each business, including the effects of derivative financial instruments related to that financing.

g) Investments in Shares:

Investments in shares of associated companies where the Company holds 10% or more of a public company, 25% or more of a non-public company, or exercises significant influence according to NIF C-7 (see Note 2 J), are initially recorded at their acquisition cost as of acquisition date and are subsequently accounted for by the equity method. In order to apply the equity method from associates, the Company uses the investee's financial statements for the same period as the Company's consolidated financial statements and converts them to Mexican FRS if the investee reports financial information in a different GAAP. Equity method income from associates is presented in the consolidated income statements as part of the income from continuing operations.

Goodwill identified at the investment's acquisition date is presented as part of the investment of shares of an associate in the consolidated balance sheet.

On May 1, 2010, the Company started to account for its 20% interest in Heineken Group under the equity method (see Notes 5 B and 9). Heineken is an international company which prepares its information based on International Financial Reporting Standards (IFRS). The Company has analyzed differences between Mexican FRS and IFRS to reconcile Heineken's net controlling interest income and comprehensive income as required by NIF C-7, in order to estimate the impact on its figures.

Investments in affiliated companies in which the Company does not have significant influence are recorded at acquisition cost and restated using the consumer price index if that entity operates in an inflationary economic environment.

h) Property, Plant and Equipment:

Property, plant and equipment are initially recorded at their cost of acquisition and/or construction. The comprehensive financing result related to the acquisition or construction of qualifying asset is capitalized as part of the cost of that asset. Major maintenance costs are capitalized as part of total acquisition cost. Routine maintenance and repair costs are expensed as incurred. Property, plant and equipment also may include costs of dismantling and removing the items and restoring the site on which they are located. In 2011 bottles and cases are also part of property, plant and equipment and 2010 has been also aggregated to conform this presentation.

Investments in fixed assets in progress consist of property, plant and equipment not yet in service, in other words, that are not yet used for the purpose that they were bought, built or developed. The Company expects to complete those investments during the following 12 months.

Depreciation is computed using the straight-line method over acquisition cost, reduced by their residual values. Where an item of property, plant and equipment comprises major components having different useful lives, they are accounted and depreciated for as separate items (major components) of property, plant and equipment. The Company estimates depreciation rates, considering the estimated useful lives of the assets, which along with residual value is reviewed, and modified if appropriate, at each financial year-end.

The estimated useful lives of the Company's principal assets are as follows:

Returnable and Non-Returnable Bottles:

The Company has two types of bottles: returnable and non-returnable.

- Non returnable: Are recorded in the results of operations at the time of product sale.

- Returnable: Are classified as long-lived assets as a component of property, plant and equipment.

There are two types of returnable bottles:

- Those that are in the Company's control within its facilities, plants and distribution centers; and

- Those that have been placed in the hands of customers, but still belong to the Company.

Returnable bottles that have been placed in the hands of customers are subject to an agreement with a retailer pursuant to which the Company retains ownership. These bottles are monitored by sales personnel during periodic visits to retailers and the Company has the right to charge any breakage identified to the retailer. Bottles that are not subject to such agreements are expensed when placed in the hands of retailers.

The Company's returnable bottles in the market and for which a deposit from customers has been received are presented net of such deposits, and the difference between the cost of these assets and the deposits received is depreciated according to their useful lives.

Leasing Contracts:

The Company leases assets such as property, land, and transportation, machinery and computer equipments.

Leases are capitalized if: i) the contract transfers ownership of the leased asset to the lessee at the end of the lease, ii) the contract contains an option to purchase the asset at a bargain purchase price, iii) the lease period is substantially equal to the remaining useful life of the leased asset or iv) the present value of future minimum payments at the inception of the lease is substantially equal to the market value of the leased asset, net of any residual value.

When the inherent risks and benefits of a leased asset remains substantially with the lessor, leases are classified as operating and rent is charged to results of operations as incurred.

i) Other Assets:

Other assets represent payments whose benefits will be received in future years and mainly consist of the following:

- Agreements with customers for the right to sell and promote the Company's products during certain periods of time, which are considered monetary assets and amortized under the straight-line method over the life of the contract.

The amortization is recorded reducing net sales, which during years ended December 31, 2011, 2010 and 2009, amounted to Ps. 803, Ps. 553 and Ps. 604, respectively. - Leasehold improvements are amortized using the straight-line method, over the shorter of the useful life of the assets and the period of the lease. The amortization of leasehold improvements as of December 31, 2011, 2010 and 2009 were Ps. 590, Ps. 518 and Ps. 471, respectively.

Intangible assets represent payments whose benefits will be received in future years. These assets are classified as either intangible assets with a finite useful life or intangible assets with an indefinite useful life, in accordance with the period over which the Company is expected to receive the benefits.

Intangible assets with finite useful lives are amortized and mainly consist of:

- Information technology and management systems costs incurred during the development stage which are currently in use. Such amounts were capitalized and then amortized using the straight-line method over the useful life of those assets. Expenses that do not fulfill the requirements for capitalization are expensed as incurred.

- Other computer systems cost in the development stage, not yet in use. Such amounts are capitalized as they are expected to add value such as income or cost savings in the future. Such amounts will be amortized on a straight-line basis over their estimated useful life after they are placed in service.

- Long-term alcohol licenses are amortized using the straight-line method, and are presented as part of intangible assets of finite useful life.

There are seven bottler agreements for Coca-Cola FEMSA's territories in Mexico; two expire in June 2013, two expire in May 2015 and additionally three contracts that arose from the merger with Grupo Tampico and CIMSA, expire in September 2014, April and July 2016. The bottler agreement for Argentina expires in September 2014, for Brazil expires in April 2014, in Colombia in June 2014, in Venezuela in August 2016, in Guatemala in March 2015, in Costa Rica in September 2017, in Nicaragua in May 2016 and in Panama in November 2014. All of the Company's bottler agreements are automatically renewable for ten-year terms, subject to the right of each party to decide not to renew any of these agreements. In addition, these agreements generally may be terminated in the case of material breach. Termination would prevent Coca-Cola FEMSA from selling Coca-Cola trademark beverages in the affected territory and would have an adverse effect on its business, financial conditions, results from operations and prospects.

Goodwill represents the excess of the acquisition cost over the fair value of the Company's share in identifiable net assets on the acquisition date. It equates to synergies both existing in the acquired operations and those further expected to be realized upon integration. Goodwill is recognized separately and is carried at cost, less accumulated impairment losses.

k) Impairment of Investments in Shares, Long-Lived Assets and Goodwill:

The Company reviews the carrying value of its long-lived assets and goodwill for impairment and determines whether impairment exists, by comparing the book value of the assets with its fair value which is calculated using recognized methodologies. In case of impairment, the Company records the resulting fair value.

For depreciable and amortizable long-lived assets, such as property, plant and equipment and certain other definite long–lived assets, the Company performs tests for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset or group of assets may not be recoverable through their expected future cash flows.

For indefinite life intangible assets, such as distribution rights and trademarks, the Company tests for impairment on an annual basis and whenever certain circumstances indicate that the carrying amount of those intangible assets exceeds its implied fair value calculated using recognized methodologies consistent with them.

For goodwill, the Company tests for impairment on an annual basis and whenever certain circumstances indicate that the carrying amount of the reporting unit might exceed its implied fair value.

For investments in shares, including its goodwill, the Company performs impairment tests whenever certain events or changes in circumstances indicate that the carrying amount may exceed fair value. When the events or circumstances are considered by the Company as an evidence of impairment that is other than temporary, a loss in value is recognized. Impairment charges regarding long-lived assets and goodwill are recognized in other expenses and charges regarding investments in shares are recognized as a decrease in the equity income method of the period.

Impairments regarding amortizable and indefinite life intangible assets are presented in Note 11. No impairment was recognized regarding to depreciable long-lived assets, goodwill nor investments in shares.

l) Payments from The Coca-Cola Company:

The Coca-Cola Company participates in certain advertising and promotional programs as well as in Coca-Cola FEMSA's refrigeration equipment and returnable bottles investment program. The contributions received for advertising and promotional incentives are included as a reduction of selling expenses. The contributions received for the refrigeration equipment and returnable bottles investment program are recorded as a reduction of the investment in refrigeration equipment and returnable bottles. Total contributions received were Ps. 2,561, Ps. 2,386 and Ps. 1,945 during the years ended December 31, 2011, 2010 and 2009, respectively.

m) Employee Benefits:

Employee benefits include obligations for pension and retirement plans, seniority premiums, postretirement medical services and severance indemnity liabilities other than restructuring, all based on actuarial calculations, using the projected unit credit method. Costs related to compensated absences, such as vacations and vacation premiums, are recognized on an accrual basis.

Employee benefits are considered to be non-monetary and are determined using long-term assumptions. The yearly cost of employee benefits is charged to income from operations and labor cost of past services is recorded as expenses over the remaining working life period of the employees.

Certain subsidiaries of the Company have established funds for the payment of pension benefits, seniority premiums and postretirement medical services through irrevocable trusts of which the employees are named as beneficiaries.

n) Contingencies:

The Company recognizes a liability for a loss when it is probable that certain effects related to past events, would materialize and could be reasonably estimated. These events and its financial impact are disclosed as loss contingencies in the consolidated financial statements and include penalties, interests and any other charge related to contingencies. The Company does not recognize an asset for a gain contingency unless it is certain that will be collected.

o) Commitments:

The Company discloses all its commitments regarding material long-lived assets acquisitions, and all contractual obligations (see Note 24 F).

p) Revenue Recognition:

Revenue is recognized in accordance with stated shipping terms, as follows:

- For Coca-Cola FEMSA sales of products are recognized as revenue upon delivery to the customer and once the customer has taken ownership of the goods. Net sales reflect units delivered at list prices reduced by promotional allowances, discounts and the amortization of the agreements with customers to obtain the rights to sell and promote the products of Coca-Cola FEMSA; and

- For FEMSA Comercio retail sales, net revenues are recognized when the product is delivered to customers, and customers take possession of products.

q) Operating Expenses:

Operating expenses are comprised of administrative and selling expenses. Administrative expenses include labor costs (salaries and other benefits) of employees not directly involved in the sale of the Company's products, as well as professional service fees, depreciation of office facilities and amortization of capitalized information technology system implementation costs.

Selling expenses include:

- Distribution: labor costs (salaries and other benefits); outbound freight costs, warehousing costs of finished products, breakage of returnable bottles in the distribution process, depreciation and maintenance of trucks and other distribution facilities and equipment. For the years ended December 31, 2011, 2010 and 2009, these distribution costs amounted to Ps. 15,125, Ps. 12,774 and Ps. 13,395, respectively;

- Sales: labor costs (salaries and other benefits) and sales commissions paid to sales personnel; and

- Marketing: labor costs (salaries and other benefits), promotional expenses and advertising costs.

Other expenses include Employee Profit Sharing ("PTU"), gains or losses on disposals of long-lived assets, impairment of long-lived assets, contingencies reserves as well as their subsequent interest and penalties, severance payments derived from restructuring programs and all other non-recurring expenses related to activities different from the main activities of the Company that are not recognized as part of the comprehensive financing result.

PTU is applicable to Mexico and Venezuela. In Mexico, employee profit sharing is computed at the rate of 10% of the individual company taxable income, except for considering cumulative dividends received from resident legal persons in Mexico, depreciation of historical rather restated values, foreign exchange gains and losses, which are not included until the asset is disposed of or the liability is due and other effects of inflation are also excluded. In Venezuela, employee profit sharing is computed at a rate equivalent to 15% of after tax income, and it is no more than four months of salary.

According to the assets and liabilities method described in NIF D-4 Income Taxes, the Company does not expect relevant deferred items to materialize. As a result, the Company has not recognized deferred employee profit sharing as of either December 31, 2011, 2010 or 2009.

Severance indemnities resulting from a restructuring program and associated with an ongoing benefit arrangement are charged to other expenses on the date when the Company has made the decision to dismiss personnel under a formal program or for specific causes.

s) Income Taxes:

Income tax is charged to results as incurred, as are deferred income taxes. For purposes of recognizing the effects of deferred income taxes in the consolidated financial statements, the Company utilizes both retrospective and prospective analysis over the medium term when more than one tax regime exists per jurisdiction and recognizes the amount based on the tax regime it expects to be subject to, in the future. Deferred income taxes assets and liabilities are recognized for temporary differences resulting from comparing the book and tax values of assets and liabilities plus any future benefits from tax loss carryforwards. Deferred income tax assets are reduced by any benefits for which it is more likely than not that they are not realizable.

The balance of deferred taxes is comprised of monetary and non-monetary items, based on the temporary differences from which it is derived. Deferred taxes are classified as a long-term asset or liability, regardless of when the temporary differences are expected to reverse.

The Company determines deferred taxes for temporary differences of its permanent investments.

The deferred tax provision to be included in the income statement is determined by comparing the deferred tax balance at the end of the year to the balance at the beginning of the year, excluding from both balances any temporary differences that are recorded directly in stockholders' equity. The deferred taxes related to such temporary differences are recorded in the same stockholders' equity account that gave rise to them.

t) Comprehensive Financing Result:

Comprehensive financing result includes interest, foreign exchange gain and losses, market value gain or loss on ineffective portion of derivative financial instruments and gain or loss on monetary position, except for those amounts capitalized and those that are recognized as part of the cumulative comprehensive income (loss). The components of the Comprehensive Financing Result are described as follows:

- Interest: Interest income and expenses are recorded when earned or incurred, respectively, except for interest capitalized on the financing of long-term assets;

- Foreign Exchange Gains and Losses: Transactions in foreign currencies are recorded in local currencies using the exchange rate applicable on the date they occur. Assets and liabilities in foreign currencies are adjusted to the year-end exchange rate, recording the resulting foreign exchange gain or loss directly in the income statement, except for the foreign exchange gain or loss from the intercompany financing foreign currency denominated balances that are considered to be of a long-term investment nature and the foreign exchange gain or loss from the financing of long-term assets (see Note 3);

- Gain or Loss on Monetary Position: The gain or loss on monetary position results from the changes in the general price level of monetary accounts of those subsidiaries that operate in inflationary environments (see Note 4 A), which is determined by applying inflation factors of the country of origin to the net monetary position at the beginning of each month and excluding the intercompany financing in foreign currency that is considered as long-term investment because of its nature (see Note 3), as well as the gain or loss on monetary position from long-term liabilities to finance long-term assets, and

- Market Value Gain or Loss on Ineffective Portion of Derivative Financial Instruments: Represents the net change in the fair value of the ineffective portion of derivative financial instruments, the net change in the fair value of those derivative financial instruments that do not meet hedging criteria for accounting purposes; and the net change in the fair value of embedded derivative financial instruments.

The Company is exposed to different risks related to cash flows, liquidity, market and credit. As a result the Company contracts in different derivative financial instruments in order to reduce its exposure to the risk of exchange rate fluctuations between the Mexican peso and other currencies, the risk of exchange rate and interest rate fluctuations associated with its borrowings denominated in foreign currencies and the exposure to the risk of fluctuation in the costs of certain raw materials.

The Company values and records all derivative financial instruments and hedging activities, including certain derivative financial instruments embedded in other contracts, in the balance sheet as either an asset or liability measured at fair value, considering quoted prices in recognized markets. If such instruments are not traded in a formal market, fair value is determined by applying techniques based upon technical models supported by sufficient, reliable and verifiable market data, recognized in the financial sector. Changes in the fair value of derivative financial instruments are recorded each year in current earnings or as a component of cumulative other comprehensive income (loss), based on the item being hedged and the ineffectiveness of the hedge.

As of December 31, 2011 and 2010, the balance in other current assets of derivative financial instruments was Ps. 511 and Ps. 24 (see Note 8), and in other assets Ps. 850 and Ps. 708 (see Note 12), respectively. The Company recognized liabilities regarding derivative financial instruments in other current liabilities of Ps. 69 and Ps. 41 (see Note 24 A), as of the end of December 31, 2011 and 2010, respectively, and other liabilities of Ps. 565 and Ps. 653 (see Note 24 B) for the same periods.

The Company designates its financial instruments as cash flows hedges at the inception of the hedging relationship when transactions meet all hedging accounting requirements. For cash flows hedges, the effective portion is recognized temporarily in cumulative other comprehensive income (loss) within stockholders' equity and subsequently reclassified to current earnings at the same time the hedged item is recorded in earnings. When derivative financial instruments do not meet all of the accounting requirements for hedging purposes, the change in fair value is immediately recognized in net income. For fair value hedges, the changes in the fair value are recorded in the consolidated results in the period the change occurs as part of the market value gain or loss on ineffective portion of derivative financial instruments.

The Company identifies embedded derivatives that should be segregated from the host contract for purposes of valuation and recognition. When an embedded derivative is identified and the host contract has not been stated at fair value, the embedded derivative is segregated from the host contract, stated at fair value and is classified as trading. Changes in the fair value of the embedded derivatives at the closing of each period are recognized in the consolidated results.

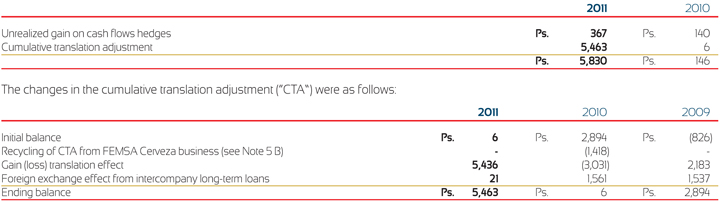

v) Cumulative Other Comprehensive Income (OCI):

The cumulative other comprehensive income represents the period net income as described in NIF B-3 "Income Statement," plus the cumulative translation adjustment resulted from translation of foreign subsidiaries and associates to Mexican pesos and the effect of unrealized gain/loss on cash flows hedges from derivative financial instruments.

The changes in the deferred income tax from the cumulative translation adjustment amounted to a provision of Ps. 2,779 and a credit of Ps. 352 for the years ended December 2011 and 2010, respectively (see Note 23 C).

w) Provisions:

Provisions are recognized for obligations that result from a past event that will probably result in the use of economic resources and that can be reasonably estimated. Such provisions are recorded at net present values when the effect of the discount is significant. The Company has recognized provisions regarding contingencies and vacations in the consolidated financial statements.

x) Issuances of Subsidiary Stock:

The Company recognizes issuances of a subsidiary's stock as a capital transaction. The difference between the book value of the shares issued and the amount contributed by the non-controlling interest holder or a third party is recorded as additional paid-in capital.

y) Earnings per Share:

Earnings per share are determined by dividing net controlling interest income by the average weighted number of shares outstanding during the period.

Earnings per share before discontinued operations are calculated by dividing consolidated net income before discontinued operations by the average weighted number of shares outstanding during the period.

Earnings per share from discontinued operations are calculated by dividing net income from discontinued operations plus income from the exchange of shares with Heineken, net of taxes, by the average weighted number of shares outstanding during the period.

z) Information by Segment:

The analytical information by segment is presented considering the business units (Subholding Companies as defined in Note 1) and geographic areas in which the Company operates, which is consistent with the internal reporting presented to the Chief Operating Decision Maker, which is considered to be the main authority of the entity. A segment is a component of the Company that engages in business activities from which it earns or is in the process of obtaining revenues, and incurs in the related costs and expenses, including revenues and costs and expenses that relate to transactions with any of Company's other components. All segments' operating results are reviewed regularly by the Chief Operating Decision Maker to make decisions about resources to be allocated to the segment and to assess its performance, and for which financial information is available.

The main indicators used by the Chief Operating Decision Maker to evaluate performance of the Company in each segment are its income from operations and cash flow from operations before changes in working capital and provisions, which the Company defined as the result of subtracting cost of sales and operating expenses from total revenues and income from operations plus depreciation and amortization, respectively. Inter-segment transfers or transactions are entered and presented into under accounting policies of each segment which are the same to those applied by the Company. Intercompany operations are eliminated and presented within the consolidation adjustment column included in the table in Note 25. Unallocated results items comprise other expenses, net and other net finance expenses (see Note 25).