For the years ended December 31, 2011, 2010 and 2009. Amounts expressed in millions of U.S. dollars ($) and in millions of Mexican pesos (Ps.).

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 |

19 Fair Value of Financial Instruments

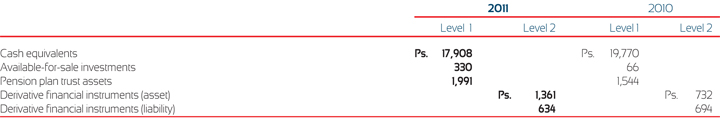

The Company uses a three level fair value hierarchy to prioritize the inputs used to measure fair value. The three levels of inputs are described as follows:

- Level 1: quoted prices (unadjusted) in active markets for identical assets or liabilities that the reporting entity has the ability to access at the measurement date.

- Level 2: inputs other than quoted prices included within level 1 that are observable for the asset or liability, either directly or indirectly.

- Level 3: are unobservable inputs for the asset or liability. Unobservable inputs shall be used to measure fair value to the extent that observable inputs are not available, thereby allowing for situations in which there is little, if any, market activity for the asset or liability at the measurement date.

The Company does not use inputs classified as level 3 for fair value measurement.

a) Total Debt:

The fair value of long-term debt is determined based on the discounted value of contractual cash flows, in which the discount rate is estimated using rates currently offered for debt of similar amounts and maturities. The fair value of notes is based on quoted market prices.

b) Interest Rate Swaps:

The Company uses interest rate swaps to offset the interest rate risk associated with its borrowings, pursuant to which it pays amounts based on a fixed rate and receives amounts based on a floating rate. These instruments are recognized in the consolidated balance sheet at their estimated fair value and have been designated as a cash flows hedge. The estimated fair value is based on formal technical models. Changes in fair value were recorded in cumulative other comprehensive income until such time as the hedged amount is recorded in earnings.

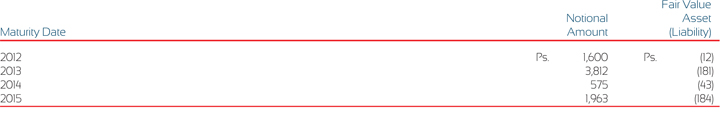

At December 31, 2011, the Company has the following outstanding interest rate swap agreements:

A portion of certain interest rate swaps do not meet the hedging criteria for accounting purposes; consequently, changes in the estimated fair value of the ineffective portion were recorded in the consolidated results as part of the comprehensive financing result.

The net effect of expired contracts that met hedging criteria is recognized as interest expense as part of the comprehensive financing result.

c) Forward Agreements to Purchase Foreign Currency:

The Company enters into forward agreements to reduce its exposure to the risk of exchange rate fluctuations between the Mexican peso and other currencies. These instruments are recognized in the consolidated balance sheet at their estimated fair value which is determined based on prevailing market exchange rates to end the contracts at the end of the period. For contracts that meet hedging criteria, the changes in the fair value are recorded in cumulative other comprehensive income prior to expiration. Net gain/loss on expired contracts is recognized as part of foreign exchange.

Net changes in the fair value of forward agreements that do not meet hedging criteria for accounting purposes are recorded in the consolidated results as part of the comprehensive financing result. The net effect of expired contracts that do not meet hedging criteria for accounting purposes is recognized as a market value gain (loss) on ineffective portion of derivative financial instruments.

d) Options to Purchase Foreign Currency:

The Company has entered into a collar strategy to reduce its exposure to the risk of exchange rate fluctuations. A collar is a strategy that limits the exposure to the risk of exchange rate fluctuations in a similar way as a forward agreement.

These instruments are recognized in the consolidated balance sheet at their estimated fair value which is determined based on prevailing market exchange rates to terminate the contracts at the end of the period. Changes in the fair value of these options, corresponding to the intrinsic value are initially recorded as part of cumulative other comprehensive income. Changes in the fair value, corresponding to the intrinsic value are recorded in the income statement under the capture "market value gain/loss on the ineffective portion of derivative financial instruments," as part of the consolidated results. Net gain/loss on expired contracts is recognized as part of cost of goods sold.

e) Cross Currency Swaps:

The Company enters into cross currency swaps to reduce its exposure to risks of exchange rate and interest rate fluctuations associated with its borrowings denominated in U.S. dollars and other foreign currencies. These instruments are recognized in the consolidated balance sheet at their estimated fair value which is estimated based on formal technical models. These contracts are designated as fair value hedges. The fair value changes related to those cross currency swaps are recorded as part of the ineffective portion of derivative financial instruments, net of changes related to the long-term liability.

Net changes in the fair value of current and expired cross currency swaps contracts that did not meet the hedging criteria for accounting purposes are recorded as a gain/loss in the market value on the ineffective portion of derivative financial instruments in the consolidated results as part of the comprehensive financing result.

f) Commodity Price Contracts:

The Company enters into commodity price contracts to reduce its exposure to the risk of fluctuation in the costs of certain raw material. The fair value is estimated based on the market valuations to the end of the contracts at the date of closing of the period. Changes in the fair value are recorded in cumulative other comprehensive income.

The fair value of expired commodity price contracts were recorded in cost of sales where the hedged item was recorded.

g) Embedded Derivative Financial Instruments:

The Company has determined that its leasing contracts denominated in U.S. dollars host embedded derivative financial instruments. The fair value is estimated based on formal technical models. Changes in the fair value were recorded in current earnings in the comprehensive financing result as market value on derivative financial instruments.

h) Notional Amounts and Fair Value of Derivative Instruments that Met Hedging Criteria:

(1) Expires in 2012.

(2) Maturity dates in 2012 and 2013.

(3) Maturity dates in 2012 and 2015.

(4) Expires in 2017.

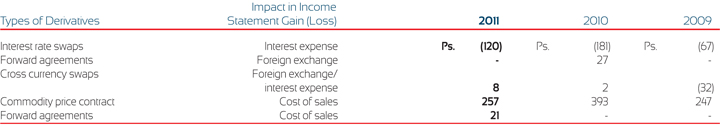

i) Net Effects of Expired Contracts that Met Hedging Criteria:

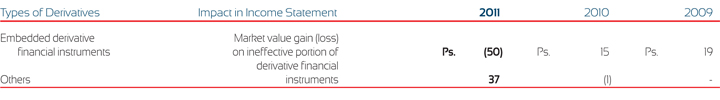

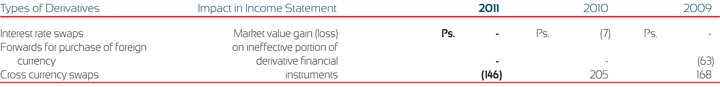

j) Net Effect of Changes in Fair Value of Derivative Financial Instruments that Did Not Meet the Hedging Criteria for Accounting Purposes:

k) Net Effect of Changes in Fair Value of Other Derivative Financial Instruments that Did Not Meet the Hedging Criteria for Accounting Purposes: