AUDITED FINANCIAL RESULTS FOR THE TWELVE MONTHS ENDED DECEMBER 31, 2011

COMPARED TO THE TWELVE MONTHS ENDED DECEMBER 31, 2010.

Set forth below is certain audited financial information for Fomento Económico Mexicano, S.A.B. de C.V. and its subsidiaries ("FEMSA" or the "Company") (NYSE: FMX; BMV: FEMSA UBD). FEMSA is a holding company whose principal activities are grouped mainly under the following subholding companies (the "Subholding Companies"): Coca-Cola FEMSA, S.A.B de C.V. ("Coca-Cola FEMSA" or "KOF"), which engages in the production, distribution and marketing of beverages and FEMSA Comercio, S.A. de C.V. ("FEMSA Comercio"), which engages in the operation of convenience stores.

On April 30, 2010, FEMSA announced the closing of the strategic transaction pursuant to which FEMSA agreed to exchange 100% of its beer operations for a 20% economic interest in the Heineken Group ("the transaction"). For more information regarding this acquisition, please refer to the transaction filings available at www.femsa.com/investor. FEMSA's consolidated 2011 and 2010 results reflect the transaction.

All of the figures in this report were prepared in accordance with Mexican Financial Reporting Standards ("Mexican FRS" or "Normas de Información Financiera"). The 2011 and 2010 results are stated in nominal Mexican pesos ("Pesos" or "Ps."). Translations of Pesos into US dollars ("US$") are included solely for the convenience of the reader and are determined using the noon buying rate for Pesos as published by the Federal Reserve Bank of New York on December 30, 2011, which was 13.9510 Pesos per US dollar.

This report may contain certain forward-looking statements concerning FEMSA's future performance that should be considered good faith estimates made by the Company. These forward-looking statements reflect management expectations and are based upon currently available data. Actual results are subject to future events and uncertainties, which could materially impact the Company's actual performance.

FEMSA Consolidated

2011 amounts in average Mexican pesos (billions)

Total Revenues

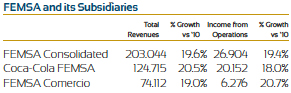

FEMSA's consolidated total revenues increased 19.6% to Ps. 203.044 billion in 2011 compared to Ps. 169.702 billion in 2010. All of FEMSA's operations—beverages and retail—contributed positively to this revenue growth. Coca-Cola FEMSA's total revenues increased 20.5% to Ps. 124.715 billion, driven by double-digit total revenues growth in both divisions and the integration of Grupo Tampico and Grupo CIMSA in the Mexican territories. FEMSA Comercio's revenues increased 19.0% to Ps. 74.112 billion, mainly driven by the opening of 1.135 net new stores combined with an average increase of 9.2% in same-store sales.

Gross Profit

Consolidated gross profit increased 19.8% to Ps. 85.035 billion in 2011 compared to Ps. 70.970 billion in 2010, driven by Coca-Cola FEMSA. Gross margin increased by 0.1 percentage points, from 41.8% of consolidated total revenues in 2010 to 41.9% in 2011.

Income from Operations

Consolidated operating expenses increased 20.0% to Ps. 58.131 billion in 2011 compared to Ps. 48.441 billion in 2010. The majority of this increase resulted from Coca-Cola FEMSA and additional operating expenses at FEMSA Comercio, resulting from accelerated store expansion. As a percentage of total revenues, consolidated operating expenses increased from 28.5% in 2010 to 28.6% in 2011.

Consolidated administrative expenses increased 6.2% to Ps. 8.249 billion in 2011 compared to Ps. 7.766 billion in 2010. As a percentage of total revenues, consolidated administrative expenses decreased from 4.6% in 2010 compared with 4.1% in 2011.

Consolidated selling expenses increased 22.6% to Ps. 49.882 billion in 2011 as compared to Ps. 40.675 billion in 2010. This increase was attributable to Coca-Cola FEMSA and FEMSA Comercio. As a percentage of total revenues, selling expenses increased 0.5 percentage points from 24.0% in 2010 to 24.5% in 2011.

Consolidated income from operations increased 19.4% to Ps. 26.904 billion in 2011 as compared to Ps. 22.529 billion in 2010. Consolidated operating margin remained at 13.3% as a percentage of 2011 consolidated total revenues.

Integral Result of Financing

Integral result of financing decreased 63.6% in 2011 to Ps. 783 million, reflecting a Foreign exchange gain due to the devaluation of the Mexican Peso on the U.S. Dollar-denominated component of our cash position.

Income Taxes

Our accounting provision for income taxes in 2011 was Ps. 7.687 billion compared to Ps. 5.671 billion in 2010, resulting in an effective tax rate of 27.1% in 2011 as compared with 24.0% in 2010.

Net Income from Continuing Operations

Net income from continuing operations increased 15.2% to Ps. 20.684 billion in 2011 compared to Ps. 17.961 billon in 2010. These results were driven by the growth in income from operations which more than compensated for an increase in the other expenses line largely driven by the net effect of non-recurring items. These include the tough comparison base caused by income from the sale of our flexible packaging business and the sale of the Mundet brand to The Coca-Cola Company during 2010.

Net Consolidated Income

Net consolidated income reached Ps. 20.684 billion in 2011 compared to 2010.

Net majority income amounted to Ps. 15.133 billion in 2011 compared to 2010. Net majority income in 2011 per FEMSA Unit 1 was Ps. 4.23 (US$ 3.03 per ADS).

Capital Expenditures

Capital Expenditures reached Ps. 12,515 billion in 2011, an increase of 12.0% from 2010 levels, driven by back-end loaded capacity-related investments at Coca-Cola FEMSA and the accelerated expansion of store openings at FEMSA Comercio.

Consolidated Balance Sheet

As of December 31, 2011, FEMSA recorded a cash balance of Ps. 27.658 billion (US$ 1.983 billion), an increase of Ps. 0.495 billion (US$ 35.5 million) as compared to December 31, 2010. Short-term debt was Ps. 5.573 billion (US$ 399.5 million) while long-term debt was Ps. 24.031 billion (US$ 1.723 billion). Our consolidated net debt balance was Ps. 1.946 billion (US$ 139.5 million).

1 FEMSA Units consist of FEMSA BD Units and FEMSA B Units. Each FEMSA BD Unit is comprised of one Series B Share, two Series D-B Shares and two Series D-L Shares. Each FEMSA B Unit is comprised of five Series B Shares. The number of FEMSA Units outstanding as of December 31, 2011 was 3,578,226,270 equivalent to the total number of FEMSA Shares outstanding as of the same date, divided by 5.

FINANCIAL RESULTS BY BUSINESS SEGMENT

COCA-COLA FEMSA

Total Revenues

Coca-Cola FEMSA total revenues increased 20.5% to Ps. 124.715 billion in 2011, compared to Ps. 103.456 billion in 2010 as a result of double-digit total revenue growth in our South America and Mexico & Central America divisions and the integration of Grupo Tampico and Grupo CIMSA in our Mexican territories during the fourth quarter of 2011. Excluding the integration of Grupo Tampico and Grupo CIMSA in Mexico, total revenues grew approximately 19%. On a currency neutral basis and excluding the recently merged territories in Mexico, total revenues increased approximately 15% in 2011.

Consolidated average price per unit case increased 13.8%, reaching Ps. 45.38 in 2011 as compared to Ps. 39.89 in 2010.

Consolidated total sales volume reached 2,648.7 million unit cases in 2011, compared to 2,499.5 million unit cases in 2010, an increase of 6.0%. Volume growth resulted from increases in sparkling beverages, which accounted for approximately 80% of incremental volumes, driven by the Coca-Cola brand. The still beverage category, mainly driven by the Jugos del Valle line of business in Mexico, Brazil and Venezuela, and Hi-C orangeade and the Cepita juice brand in Argentina contributed with approximately 15% of the incremental volumes and the bottled water category represented the balance. Excluding the integration of Grupo Tampico and Grupo CIMSA in Mexico, volumes grew 4.0% to 2,599.8 million unit cases.

Gross Profit

Cost of sales increased 21.5% to Ps. 67.488 billion in 2011 compared to Ps. 55.534 billion in 2010, as a result of higher cost of sweetener and PET costs across our operations, which were partially offset by the appreciation of the average exchange rate of the Brazilian real, the Colombian peso and the Mexican peso as applied to our U.S. Dollar-denominated raw material costs. Gross profit increased 19.4% to Ps. 57.227 billion in 2011, as compared to 2010; our gross margin decreased 0.4 percentage points to 45.9% in 2011.

Income from Operations

Operating expenses increased 20.2% to Ps. 37.075 billion in 2011. As a percentage of sales, operating expenses decreased to 29.7% in 2011 from 29.8% in 2010.

Income from operations increased 18.0% to Ps. 20.152 billion in 2011, as compared to Ps. 17.079 billion in 2010 driven by our South America division. Operating margin was 16.2% in 2011, a contraction of 0.3 percentage points as compared to 2010.

FEMSA COMERCIO

Total Revenues

FEMSA Comercio total revenues increased 19.0% to Ps. 74.112 billion in 2011 compared to Ps. 62.259 billion in 2010, primarily as a result of the opening of 1,135 net new stores during 2011, together with an average increase of same-store sales of 9.2%. As of December 31, 2011, there were a total of 9,561 stores in Mexico. FEMSA Comercio same-store sales increased an average of 9.2% compared to 2010, driven by a 4.6% increase in store traffic and 4.3% in average ticket.

Gross Profit

Cost of sales increased 18.0% to Ps. 48.636 billion in 2011, below total revenue growth, compared with Ps. 41.220 billion in 2010. As a result, gross profit reached Ps. 25.476 billion in 2011, which represented a 21.1% increase from 2010. Gross margin expanded 0.6 percentage points to reach 34.4% of total revenues. This increase reflects a positive mix shift due to the growth of higher margin categories and a more effective collaboration and execution with our key supplier partners combined with a more efficient use of promotion-related marketing resources.

Income from Operations

Operating expenses increased 21.2% to Ps. 19.200 billion in 2011 compared with Ps. 15.839 billion in 2010, largely driven by the growing number of stores as well as by the incremental expenses such as the strengthening of FEMSA Comercio's organizational structure, mainly IT-related, and targeted marketing programs. Administrative expenses increased 21.2% to Ps. 1.438 billion in 2011, compared with Ps. 1.186 billion in 2010, however, as a percentage of sales, it remained stable at 1.9%. Selling expenses increased 21.2% to Ps. 17.762 billon in 2011 compared with Ps. 14.653 billion in 2010. Income from operations increased 20.7% to Ps. 6.276 billion in 2011 compared with Ps. 5.200 billion in 2010, resulting in an operating margin expansion of 0.1 percentage points to 8.5% as a percentage of total revenues for the year, compared with 8.4% in 2010.

Key Events During 2011

Coca-Cola FEMSA shareholders approved dividend payment in the amount of Ps. 4.357 billion

On March 23, 2011, Coca-Cola FEMSA, held its Annual Ordinary General Shareholders Meeting during which its shareholders approved the annual report presented by the Board of Directors, the Company's consolidated financial statements for the year ended December 31, 2010, the declaration of dividends corresponding to fiscal year 2010 and the composition of the Board of Directors and the Finance and Planning, Audit, and Corporate Practices Committees for 2011.

Shareholders approved the payment of a cash dividend in the amount of Ps. 4.357 billion. The dividend will be paid on April 27, 2011, in the amount of Ps. 2.36 per each ordinary share, equivalent to Ps. 23.60 per ADS. In accordance with Mexican legislation requirements, shareholders approved the maximum amount that can potentially be used for share repurchase program during 2011, the amount of Ps. 400 million.

FEMSA Shareholders Approved Ps. 4.600 Billion Dividend

On March 25, 2011, FEMSA held its Annual Ordinary General Shareholders Meeting, during which the shareholders approved the Company's annual report for 2010 prepared by the Chief Executive Officer, the Company's consolidated financial statements for the year ended December 31, 2010, the declaration of dividends for the 2010 fiscal year and the election of the Board of Directors and its Committees for 2011.

The shareholders approved the payment of a cash dividend in the amount of Ps. 4.600 billion, consisting of Ps. 0.28675 per each Series "D" share and Ps. 0.2294 per each Series "B" share, which amounts to Ps. 1.3764001 per "BD" Unit (BMV: FEMSAUBD) or Ps. 13.764001 per ADS (NYSE: FMX), and Ps. 1.147 per "B" Unit (BMV: FEMSAUB). The dividend payment will be split in two equal payments, payable on May 4, 2011 and November 2, 2011. In addition, the shareholders established the amount of Ps. 3.000 billion as the maximum amount that could potentially be used for the Company's share repurchase program during 2011.

Coca-Cola FEMSA acquired Grupo Industrias Lácteas in Panama

On March 28, 2011, Coca-Cola FEMSA, announced that, together with The Coca-Cola Company, it successfully closed the acquisition of Grupo Industrias Lácteas, a leading company with a more than 50-year tradition in the Panamanian dairy and juice-based beverage categories.

This transaction represented an important step in the growth strategy of Coca-Cola FEMSA. It enabled the Company to enter the milk and value-added dairy products category, one of the most dynamic segments in terms of scale and value in the non-alcoholic beverage industry in Latin America. It further reinforces the Company's non-carbonated product portfolio in the juice-based beverage segment.

Offering Placement in Mexican Bond Market

On April 15, 2011, Coca-Cola FEMSA, announced the placement of peso-denominated bonds ("Certificados Bursátiles") in the Mexican markets.

On April 14, 2011, the Company successfully placed two tranches of "Certificados Bursátiles": a 5 year bond for Ps. 2.500 billion at a yield of 28-day TIIE plus 13 (thirteen) basis points; and a 10 year bond for Ps. 2.500 billion at a fixed rate of 8.27%. Both bonds are guaranteed by Coca-Cola FEMSA's wholly-owned subsidiary Propimex, S.A. de C.V. The "Certificados Bursátiles" were issued on Monday, April 18, 2011. A portion of the proceeds from this placement were used to pay our KOF 07 "Certificado Bursátil" at maturity on March 2012, in the amount of Ps. 3.000 billion. The remainder of the proceeds will be used by the Company for general corporate purposes, including investment expenses and working capital.

Coca-Cola FEMSA and Grupo Tampico reach an agreement to merge their bottling operations

On June 28, 2011, Coca-Cola FEMSA and Grupo Tampico S.A. de C.V. and its shareholders agreed to merge Grupo Tampico's beverage division, one of the largest family-owned bottlers in terms of sales volume in Mexico, with Coca-Cola FEMSA. The merger agreement was approved by both Coca-Cola FEMSA's and Grupo Tampico's Board of Directors and was subject to the completion of confirmatory legal, financial and operating due diligence and to customary regulatory and corporate approvals, among them, the approval of The Coca-Cola Company and the Comisión Federal de Competencia, the Mexican antitrust authority.

Coca-Cola FEMSA announces new business structure and organizational changes

On August 25, 2011, Coca-Cola FEMSA, announced a new business structure and organizational changes. In accordance with this new business structure, the Company's new reporting segments are Mexico & Central America and South America. On October 11, 2011, the Company released restated unaudited quarterly financial information for the years 2009, 2010 and 2011.This information is available on the Company's website.

Coca-Cola FEMSA and Grupo CIMSA reach an agreement to merge their bottling operations

On September 19, 2011, Coca-Cola FEMSA and Corporación de los Ángeles, S.A. de C.V. and its shareholders ("Grupo CIMSA") agreed to merge their beverage businesses. The merger agreement was approved by Coca-Cola FEMSA's Board of Directors and was subject to the completion of confirmatory legal, financial and operating due diligence and to customary regulatory and corporate approvals.

Coca-Cola FEMSA and Grupo Tampico successfully merge their bottling operations

On October 11, 2011, Coca-Cola FEMSA, announced the successful merger of Grupo Tampico's beverage division with Coca-Cola FEMSA. Coca-Cola FEMSA held an ordinary and extraordinary shareholders meeting on October 10, 2011, at which the Company's shareholders approved this merger, amended the Company's by-laws to increase the number of board members from 18 to 21 and appointed Mr. Herman Fleishman and Mr. Robert Fleishman, President and Vice President, respectively, of Grupo Tampico, as director and alternate director in our Board.

The aggregate enterprise value of this transaction was Ps. 9.300 billion, which at the time of the announcement of this merger represented an EV/EBITDA multiple of approximately 9.6 times. As a result of the completion of the due diligence process, no material adjustment was recorded, and Grupo Tampico's main shareholders received 63.5 million newly issued KOF series L shares.

Coca-Cola FEMSA assumed Ps. 2.747 billion in net debt. This transaction received all necessary approvals, among others, the approval of The Comisión Federal de Competencia, the Mexican antitrust authority, and The Coca-Cola Company.

Coca-Cola FEMSA and Grupo CIMSA successfully merge their bottling operations

On December 12, 2011, Coca-Cola FEMSA, announced the successful merger of Grupo CIMSA with Coca-Cola FEMSA. This transaction received all necessary approvals, including the approval of The Comisión Federal de Competencia, the Mexican antitrust authority, and The Coca-Cola Company. Subsequently, Coca-Cola FEMSA held an extraordinary shareholders meeting on December 9, 2011, at which the Company's shareholders approved this merger.

The aggregate enterprise value of this transaction is Ps. 11.000 billion, which at the time of the announcement of this merger represented an EV/EBITDA multiple of approximately 10 times. As a result of the completion of the due diligence process, no material adjustment was recorded, and Grupo CIMSA's main shareholders received 75.4 million newly issued KOF series L shares. Coca-Cola FEMSA assumed Ps. 2.100 billion in net debt.

Coca-Cola FEMSA and Grupo Fomento Queretano reach an agreement to merge their bottling operations

On December 15, 2011 Coca-Cola FEMSA and Grupo Fomento Queretano and its shareholders agreed to merge Grupo Fomento Queretano's beverage division with Coca-Cola FEMSA. The merger agreement has been approved by both Coca-Cola FEMSA's and Grupo Fomento Queretano's Boards of Directors and is subject to the completion of confirmatory legal, financial, and operating due diligence and to customary regulatory and corporate approvals, including the approval of The Coca-Cola Company and the Comisión Federal de Competencia, the Mexican antitrust authority.