For the years ended December 31, 2011, 2010 and 2009. Amounts expressed in millions of U.S. dollars ($) and in millions of Mexican pesos (Ps.).

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 |

3 Foreign Subsidiary Incorporation

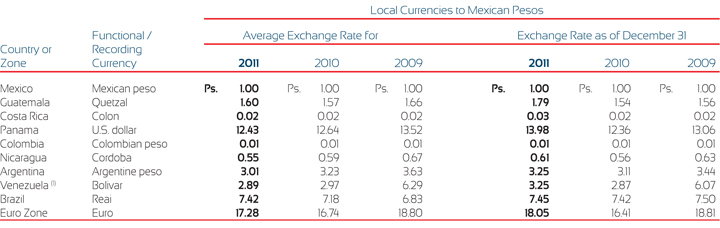

The accounting records of foreign subsidiaries are maintained in local currency and in accordance with local accounting principles of each country. For incorporation into the Company's consolidated financial statements, each foreign subsidiary's individual financial statements are adjusted to Mexican FRS, and translated into Mexican pesos, as described as follows:

- For inflationary economic environments, the inflation effects of the origin country are recognized, and subsequently translated into Mexican pesos using the year-end exchange rate for the balance sheets and income statements; and

- For non-inflationary economic environments, assets and liabilities are translated into Mexican pesos using the year-end exchange rate, stockholders' equity is translated into Mexican pesos using the historical exchange rate, and the income statement is translated using the average exchange rate of each month.

(1) Equals 4.30 bolivars per one U.S. dollar in 2011 and 2010; and 2.15 bolivars per one U.S. dollar for 2009, translated to Mexican pesos applying the year-end exchange rate.

Beginning in 2010, the government of Venezuela announced the devaluation of the Bolivar (Bs). The official exchange rate of Bs 2.150 to the dollar, in effect since 2005, was replaced on January 8, 2010, with a dual-rate regime, which allows two official exchange rates, one for essential products of Bs 2.60 per U.S. dollar and other non-essential products of Bs 4.30 per U.S. dollar. According to this, the exchange rate used by the company to convert the information of the operation for this country changed from Bs 2.15 to 4.30 per U.S. dollar in 2010. As a result of this devaluation, the balance sheet of the Coca-Cola FEMSA Venezuelan subsidiary reflected a reduction in other comprehensive income (part of shareholder's equity) of Ps. 3,700 which was accounted for at the time of the devaluation in January 2010. The Company has operated under exchange controls in Venezuela since 2003 that affect its ability to remit dividends abroad or make payments other than in local currencies and that may increase the real price to us of raw materials purchased in local currency.

During December 2010, authorities of the Venezuelan Government announced the unification of their two fixed U.S. dollar exchange rates to Bs 4.30 per U.S. dollar, effective January 1, 2011. As a result of this change, the translation of balance sheet of the Coca-Cola FEMSA's Venezuelan subsidiary did not have an impact in shareholders' equity, since transactions performed by this subsidiary were already using the Bs 4.30 exchange rate.

Intercompany financing balances with foreign subsidiaries are considered as long-term investments, since there is no plan to pay such financing in the foreseeable future. Monetary position and exchange rate fluctuation regarding this financing are recorded in equity as part of cumulative translation adjustment, in cumulative other comprehensive income (loss).

The translation of assets and liabilities denominated in foreign currencies into Mexican pesos is for consolidation purposes and does not indicate that the Company could realize or settle the reported value of those assets and liabilities in Mexican pesos. Additionally, this does not indicate that the Company could return or distribute the reported Mexican peso value equity to its shareholders.