For the years ended December 31, 2011, 2010 and 2009. Amounts expressed in millions of U.S. dollars ($) and in millions of Mexican pesos (Ps.).

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 |

21 Stockholders' Equity

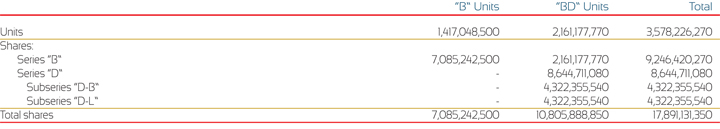

The capital stock of FEMSA is comprised of 2,161,177,770 BD units and 1,417,048,500 B units.

As of December 31, 2011 and 2010, the capital stock of FEMSA was comprised of 17,891,131,350 common shares, without par value and with no foreign ownership restrictions. Fixed capital stock amounts to Ps. 300 (nominal value) and the variable capital may not exceed 10 times the minimum fixed capital stock amount.

The characteristics of the common shares are as follows:

- Series "B" shares, with unlimited voting rights, which at all times must represent a minimum of 51% of total capital stock;

- Series "L" shares, with limited voting rights, which may represent up to 25% of total capital stock; and

- Series "D" shares, with limited voting rights, which individually or jointly with series "L" shares may represent up to 49% of total capital stock.

- Subseries "D-L" shares may represent up to 25% of the series "D" shares;

- Subseries "D-B" shares may comprise the remainder of outstanding series "D" shares; and

- The non-cumulative premium dividend to be paid to series "D" stockholders will be 125% of any dividend paid to series "B" stockholders.

- "B units" each of which represents five series "B" shares and which are traded on the BMV;

- "BD units" each of which represents one series "B" share, two subseries "D-B" shares and two subseries "D-L" shares, and which are traded both on the BMV and the NYSE;

The net income of the Company is subject to the legal requirement that 5% thereof be transferred to a legal reserve until such reserve equals 20% of capital stock at nominal value. This reserve may not be distributed to stockholders during the existence of the Company, except as a stock dividend. As of December 31, 2011 and 2010, this reserve in FEMSA amounted to Ps. 596 (nominal value).

Retained earnings and other reserves distributed as dividends, as well as the effects derived from capital reductions, are subject to income tax at the rate in effect at the date of distribution, except for restated stockholder contributions and distributions made from consolidated taxable income, denominated "Cuenta de Utilidad Fiscal Neta" ("CUFIN").

Dividends paid in excess of CUFIN are subject to income tax at a grossed-up rate based on the current statutory rate. Since 2003, this tax may be credited against the income tax of the year in which the dividends are paid, and in the following two years against the income tax and estimated tax payments. As of December 31, 2011, FEMSA's balances of CUFIN amounted to Ps. 62,925.

At the ordinary stockholders' meeting of FEMSA held on March 25, 2011, stockholders approved dividends of Ps. 0.22940 Mexican pesos (nominal value) per series "B" share and Ps. 0.28675 Mexican pesos (nominal value) per series "D" share that were paid in May and November, 2011. Additionally, the stockholders approved a reserve for share repurchase of a maximum of Ps. 3,000. As of December 31, 2011, the Company has not repurchased shares.

At an ordinary stockholders' meeting of Coca-Cola FEMSA held on March 23, 2011, the stockholders approved a dividend of Ps. 4,358 that was paid on April 27, 2011. The corresponding payment to the non-controlling interest was Ps. 2,017.

As of December 31, 2011, 2010 and 2009 the dividends declared and paid by the Company and Coca-Cola FEMSA were as follows: