For the years ended December 31, 2011, 2010 and 2009. Amounts expressed in millions of U.S. dollars ($) and in millions of Mexican pesos (Ps.).

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 |

26 Implementation of International Financial Reporting Standards

The consolidated financial statements to be issued by the Company for the year ending December 31, 2012 will be its first annual financial statements that comply with IFRS as issued by the International Accounting Standards Board. The transition date is January 1, 2011 and, therefore, the year ended December 31, 2011 will be the comparative period to be covered. IFRS 1, "First-Time Adoption of International Financial Reporting Standards" (IFRS 1), sets mandatory exceptions and allows certain optional exemptions to the complete retrospective application of IFRS.

The Company applied the following mandatory exceptions to retrospective application of IFRS, effective as of the transition date:

- Accounting Estimates:

Estimates prepared under IFRS as of January 1, 2011 are consistent with the estimates recognized under Mexican FRS as of the same date, unless the Company is required to adjust such estimates to agree with IFRS. - Derecognition of Financial Assets and Liabilities:

The Company applied the derecognition rules of IAS 39, "Financial Instruments: Recognition and Measurement" (IAS 39), prospectively for transactions occurring on or after the date of transition. - Hedge Accounting:

As of the transition date, the Company measured at fair value all derivative financial instruments and hedging relationships designated and documented effectively as accounting hedges as required by IAS 39, which is consistent with the treatment under Mexican FRS.

As a result, there was no impact in the Company's consolidated financial statements due to the application of this exception. - Non-controlling Interest:

The Company applied the requirements in IAS 27, "Consolidated and Separate Financial Statements" (IAS 27) related to non-controlling interests prospectively beginning on the transition date.

- Business Combinations and Acquisitions of Associates and Joint Ventures:

According to IFRS 1, an entity may elect not to apply IFRS 3 "Business Combinations" (IFRS 3) retrospectively to acquisitions made prior of the transition date to IFRS.

The exemption for past business combinations also applies to past acquisitions of investments in associates and of interests in joint ventures.

The Company adopted this exemption and did not amend its business acquisitions or investments in associates and joint ventures prior to the transition date and it did not remeasure the values determined at acquisition dates, including the amount of previously recognized goodwill in past acquisitions. - Share-based Payments:

The Company has share-based plans, which it pays to its qualifying employees based on its own shares and those of its subsidiary Coca-Cola FEMSA. Management decided to apply the optional exemptions established in IFRS 1, where it did not apply IFRS 2 "Share-based Payment" (IFRS 2), (i) to the equity instruments granted before November 7, 2002, (ii) to equity instruments granted after November 7, 2002 and that were earned before the latter of (a) the IFRS transition date and (b) January 1, 2005, and (iii) to liabilities related to share-based payment transactions that were settled before the transition date. - Deemed Cost:

An entity may individually elect to measure an item of its property, plant and equipment at the transition date to IFRS at its fair value and use that fair value as its deemed cost at that date. In addition, a first-time adopter may elect to use a previous GAAP revaluation of an item of property, plant and equipment at, or before, of the transition date to IFRS as deemed cost at the date of the revaluation, if the revaluation was, at the date of the revaluation, broadly comparable to: (i) fair value; or (ii) cost or depreciated cost in accordance with IFRS, adjusted to reflect changes in a general or specific price index.

The Company has presented both its property, plant, and equipment and its intangible assets at IFRS historical cost in all countries. In Venezuela this IFRS historical cost represents actual historical cost in the year of acquisition, indexed for inflation in a hyper-inflationary economy based on the provisions of IAS 29. - Cumulative Translation Effect:

A first-time adopter is neither required to recognize translation differences and accumulate these in a separate component of equity nor on a subsequent disposal of a foreign operation, to reclassify the cumulative translation difference for that foreign operation from equity to profit or loss as part of the gain or loss on disposal that would have existed at transition date.

The Company applied this exemption and consequently it reclassified the accumulated translation effect recorded under Mexican FRS to retained earnings and beginning January 1, 2011, it calculates the translation effect of its foreign operations prospectively according to IAS 21, "The Effects of Changes in Foreign Exchange Rates." - Borrowing Costs:

The Company applied the IFRS 1 exemption related to borrowing costs incurred for qualifying assets existing at the transition date based on the similar Company´s Mexican FRS accounting policy, and beginning January 1, 2011 it capitalizes eligible borrowing costs in accordance with IAS 23, "Borrowing Costs" (IAS 23).

The following disclosures provide a qualitative description of the most significant preliminary effects from the transition of IFRS determined as of the date of the issuance of the consolidated financial statements:

a) Inflation Effects:

According to Mexican FRS, the Mexican peso ceased to be the currency of an inflationary economy in December 2007, as the three year cumulative inflation as of such date did not exceed 26%.

According to IAS 29 "Hyperinflationary Economies" (IAS 29), the last hyperinflationary period for the Mexican peso was in 1998. As a result, the Company eliminated the cumulative inflation recognized within long-lived assets and contributed capital for the Company´s Mexican operations, based on Mexican FRS during the years 1999 through 2007, which were not deemed hyperinflationary for IFRS purposes.

For the foreign operations, the cumulative inflation from the acquisition date was eliminated (except in the case of Venezuela, which was deemed a hyperinflationary economy) from the date the Company began to consolidate them.

b) Employee Benefits:

According to NIF D-3 "Employee Benefits" (NIF D-3), a severance provision and the corresponding expenditure, must be recognized based on the experience of the entity in terminating the employment relationship before the retirement date, or if the entity deems to pay benefits as a result of an offer made to employees to encourage a voluntary termination. For IFRS purposes, this provision is only recorded pursuant to IAS 19 (Revised 2011), at the moment the entity has a demonstrable commitment to end the relationship with the employee or to make a bid to encourage voluntary retirement. This is evidenced by a formal plan that describes the characteristics of the termination of employment. Accordingly, at the transition date, the Company derecognized its severance indemnity recorded under Mexican FRS against retained earnings given that no such formal plan exists. A formal plan was not required for recording under Mexican FRS.

IAS 19 (Revised 2011), early adopted by the Company, eliminates the use of the corridor method, which defers the actuarial gains/losses, and requires that they recorded directly within other comprehensive income in each reporting period. The standard also eliminates deferral of past service costs and requires entities to record them in comprehensive income in each reporting period. These requirements increased its liability for employee benefits with a corresponding reduction in retained earnings at the transition date.

c) Embedded Derivatives:

For Mexican FRS purposes, the Company recorded embedded derivatives for agreements denominated in foreign currency. Pursuant to the principles set forth in IAS 39, there is an exception for embedded derivatives on those contracts that are denominated in certain foreign currencies, if for example the foreign currency is commonly used in the economic environment in which the transaction takes place. The Company concluded that all of its embedded derivatives fell within the scope of this exception.

Therefore, at the transition date, the Company derecognized all embedded derivatives recognized under Mexican FRS.

d) Stock Bonus Program:

Under Mexican FRS NIF D-3, the Company recognizes its stock bonus program plan offered to certain key executives as a defined contribution plan. IFRS requires that such share-based payment plans be recorded under the principles set forth in IFRS 2, "Share-based Payments." The most significant difference for changing the accounting treatment is related to the period during which compensation expense is recognized, which under NIF D-3 the total amount of the bonus is recorded in the period in which it was granted, while in IFRS 2 it shall be recognized over the vesting period of such awards.

Additionally, the trust that holds the equity shares allocated to executives, is considered to hold plan assets and is not consolidated under Mexican FRS. However, for IFRS SIC 12, "Consolidation - Special Purpose Entities," the Company will consolidate the trust and reflect its own shares in treasury stock and reduce the non-controlling interest for the Coca-Cola FEMSA's shares held by the trust.

e) Deferred Income Taxes:

The IFRS adjustments recognized by the Company had an impact on the calculation of deferred income taxes according to the requirements established by IAS 12, "Income Taxes" (IAS 12).

Furthermore, the Company derecognized a deferred liability recorded in the exchange of shares of FEMSA Cerveza with the Heineken Group, because IFRS prohibits the recognition of effects of current and deferred taxes that are generated on a hypothetical declaration of dividends to shareholders of the reporting Company. IFRS has an exception for recognition of a deferred tax liability for an investment in a subsidiary if the parent is able to control the timing of the reversal and it is probably that it will not reverse in the foreseeable future.

f) Retained Earnings:

All the adjustments arising from the Company's conversion to IFRS as of the transition date were recorded against retained earnings.

g) Other Differences in Presentation and Disclosures in the Financial Statements:

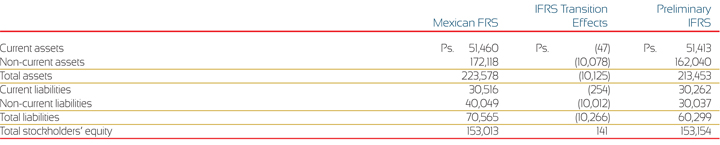

Generally, IFRS disclosure requirements are more extensive than those of NIF, which will result in increased disclosures about accounting policies, significant judgments and estimates, financial instruments and management risks, among others. The Company will restructure its Income Statement under IFRS to comply with IAS 1, "Presentation of Financial Statements" (IAS 1). In addition, there may be some other differences in presentation. There are other differences between Mexican FRS and IFRS, however. The Company considers differences mentioned above describe the significant effects. As a result of the transition to IFRS, the effects as of January 1, 2011 on the principal items of a condensed statement of financial position are described as follow:

The information presented above has been prepared in accordance with the standards and interpretations issued and in effect or issued and early adopted by the Company (as a discussed in Note 26 B) at the date of preparation of these consolidated financial statements. The standards and interpretations that are applicable at December 31, 2012, including those that will be applicable on an optional basis, are not known with certainty at the time of preparing the Mexican FRS consolidated financial statements at December 31, 2011. Additionally, the IFRS accounting policies selected by the Company may change as a result of changes in the economic environment or industry trends that are observable after the issuance of this Mexican FRS consolidated financial statements. The information presented herein, does not intend to comply with IFRS, and it should be noted that under IFRS, only one set of financial statements comprising the statements of financial position, comprehensive income, changes in stockholders' equity and cash flows, together with comparative information and explanatory notes can provide a fair presentation of the financial position of the Company, the results of its operations and cash flows.