For the years ended December 31, 2011, 2010 and 2009. Amounts expressed in millions of U.S. dollars ($) and in millions of Mexican pesos (Ps.).

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 |

15 Employee Benefits

The Company has various labor liabilities for employee benefits in connection with pension, seniority, post retirement medical and severance benefits. Benefits vary depending upon country.

a) Assumptions:

The Company annually evaluates the reasonableness of the assumptions used in its labor liabilities for employee benefits computations. Actuarial calculations for pension and retirement plans, seniority premiums, postretirement medical services and severance indemnity liabilities, as well as the cost for the period, were determined using the following long-term assumptions:

(1) For non-inflationary economies.

(2) For inflationary economies.

The basis for the determination of the long-term rate of return is supported by a historical analysis of average returns in real terms for the last 30 years of the Certificados de Tesorería del Gobierno Federal (Mexican Federal Government Treasury Certificates) for Mexican investments, treasury bonds of each country for other investments and the expected rates of long-term returns of the actual investments of the Company.

The annual growth rate for health care expenses is 5.1% in nominal terms, consistent with the historical average health care expense rate for the past 30 years. Such rate is expected to remain consistent for the foreseeable future.

Based on these assumptions, the expected benefits to be paid in the following years are as follows:

b) Balances of the Liabilities for Employee Benefits:

(1) Unrecognized net transition obligation and unrecognized prior service costs.

The accumulated actuarial gains and losses were generated by the differences in the assumptions used for the actuarial calculations at the beginning of the year versus the actual behavior of those variables at the end of the year.

c) Trust Assets:

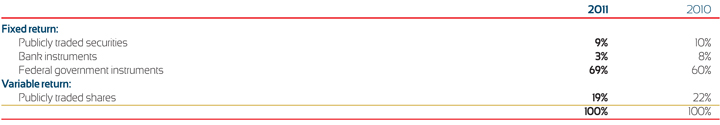

Trust assets consist of fixed and variable return financial instruments recorded at market value. The trust assets are invested as follows:

The Company has a policy of maintaining at least 30% of the trust assets in Mexican Federal Government instruments. Objective portfolio guidelines have been established for the remaining percentage, and investment decisions are made to comply with those guidelines to the extent that market conditions and available funds allow.

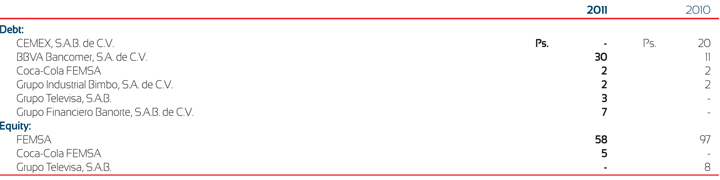

The amounts and types of securities of the Company and related parties included in plan assets are as follows:

The Company does not expect to make material contributions to plan assets during the following fiscal year.

d) Cost for the Year:

(1) Amortization of unrecognized net transition obligation and amortization of unrecognized prior service costs.

e) Changes in the Balance of the Obligations for Employee Benefits:

f) Changes in the Balance of the Trust Assets:

(1) Life annuities acquired from Allianz Mexico.

g) Variation in Health Care Assumptions:

The following table presents the impact to the postretirement medical service obligations and the expenses recorded in the income statement with a variation of 1% in the assumed health care cost trend rates.