For the years ended December 31, 2011, 2010 and 2009. Amounts expressed in millions of U.S. dollars ($) and in millions of Mexican pesos (Ps.).

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 |

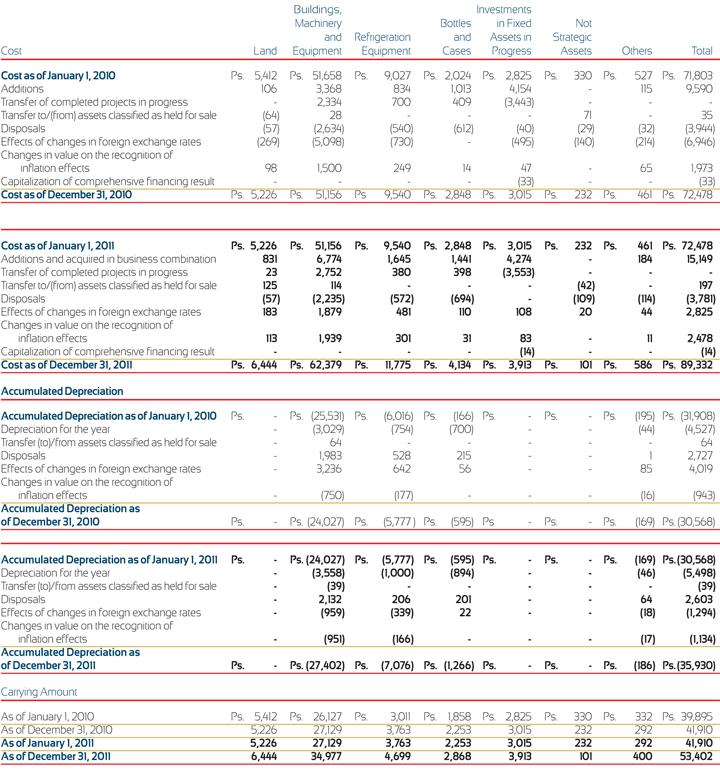

10 Property, Plant and Equipment

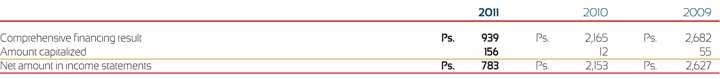

In 2011, 2010 and 2009 the Company capitalized Ps. 156, Ps. 12 and Ps. 55, respectively in comprehensive financing costs in relation to Ps. 3,748, Ps. 1,929 and Ps. 845 in qualifying assets. Amounts were capitalized assuming an annual capitalization rate of 5.8%, 5.3% and 7.2%, respectively and an estimated life of the qualifying assets of seven years. For the years ended December 31, 2011, 2010 and 2009 the comprehensive financing result is analyzed as follows:

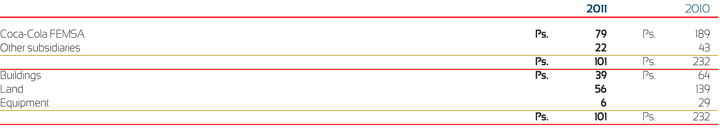

The Company has identified certain long-lived assets that are not strategic to the current and future operations of the business and are not being used, comprised of land, buildings and equipment, in accordance with an approved program for the disposal of certain investments. Such long-lived assets have been recorded at the lower of cost or net realizable value, as follows:

As a result of selling certain not strategic long-lived assets, the Company recognized gain of Ps. 85, loss of Ps. 41, and a gain of Ps. 6 for the years ended December 31, 2011, 2010 and 2009, respectively.

Long-lived assets that are available for sale have been reclassified from property, plant and equipment to other current assets. As of December 31, 2011 and 2010, long-lived assets available for sale amounted to Ps. 26 and Ps. 125 (see Note 8).