Navigating a Challenging Environment

In the face of a tough operating environment, FEMSA Comercio produced resilient results for the year. Total revenues rose 12.9% to Ps. 97.6 billion, including the results from our recent acquisitions of Farmacias YZA and Farmacias Moderna. Our increased revenues came from our continued store expansion and our comparable same-store sales growth—driven by an improvement in our average customer ticket despite consumers’ lower disposable income and a slight decline in store traffic.

Gross profit grew 14.3% to Ps. 34.6 billion, resulting in a 40 basis point gross margin expansion to 35.4% of total revenues. Our expansion in gross margin reflected a positive shift in our product mix resulting from the growth of higher margin categories, and a more effective collaboration and execution with our key supplier partners, including our greater, more efficient use of joint promotion-related marketing resources, as well as objective-based incentives.

Income from operations increased 16.6% to Ps. 7.9 billion. Our operating expenses rose at a lower rate than our revenue growth thanks to our successful cost-containment program, which offset higher expenses from our growing number of stores and distribution centers. For the year, our operating margin expanded 30 basis points to 8.1% of total revenues.

We continue to expand and enhance OXXO’s assortment of quality products and services to cater to the needs of over nine million shoppers every day.

Consumer Focus

At OXXO, we continue to expand and enhance our value proposition to satisfy our shoppers’ needs through an increasing array of quality products and services. Among our initiatives, we continue to broaden the scope of our convenient one-stop services. To optimize our consumers’ time, we expanded our correspondent bank program; in addition to Bancomer and Banamex, Mexico’s two largest financial institutions, we welcomed Santander and Scotiabank, two leading global financial institutions. Through this program, we enable customers to make cash deposits to their bank accounts and payments toward the balance of their bank credit cards at any one of OXXO’s stores across the country. As consumers come to realize the advantages of this new functionality, we look forward to eventually expanding this program to most major banks in Mexico—particularly since the number of our OXXO stores is already comparable to the combined number of branches of the 10 largest banks in the country.

Furthermore, to more effectively satisfy our consumers’ appetite at any time of the day, we continue to steadily roll out our O ‘Sabor brand menu of tacos, burritos, tortas, tamales, and pizzas. Indeed, our base menu of O ‘Sabor brand tacos and burritos is already available at more than 100 stores. Through this initiative, along with our systematic progress along the entire prepared food supply chain, we are only beginning to unlock the potential of this promising consumption occasion.

Growth

We managed to navigate significant short-term headwinds to produce same-store sales growth of 2.4%—outperforming the rate of growth of our industry. Our performance through a very challenging operating environment underscores the strength of our ever-improving value proposition, brand equity, and marketplace execution.

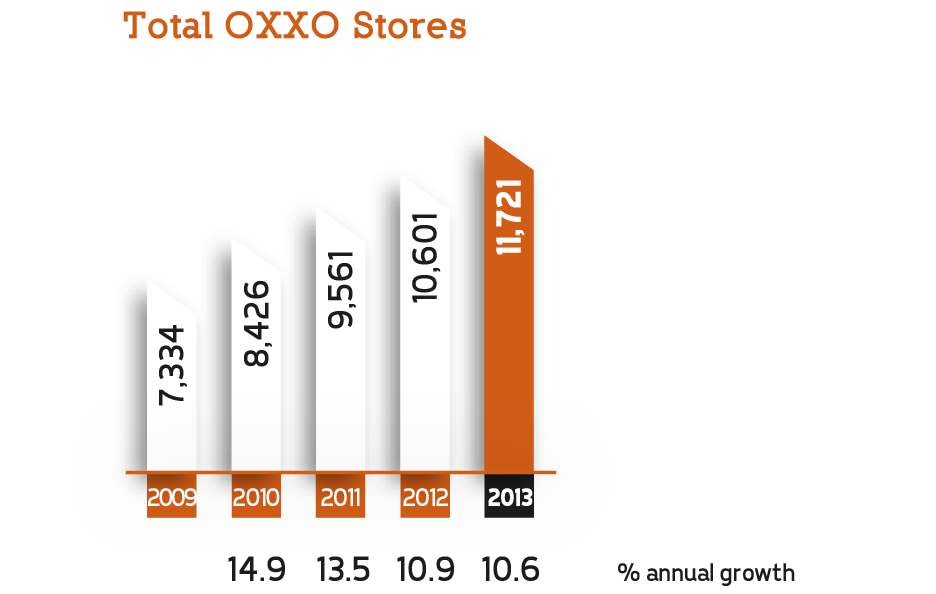

In addition to our same-store sales growth, we continued with our long-term strategy to expand OXXO’s leadership position as Mexico’s largest and fastest growing modern small-format store chain. In 2013, we opened 1,120 new stores for a total of 11,721 stores in Mexico and Colombia.

Beyond OXXO, FEMSA Comercio marked its entry into the complementary drugstore sector, taking the first steps down an important avenue for growth that leverages our capability and our platform across retail formats. Indeed, the combination of comparable small-box store formats and a similarly fragmented industry structure—coupled with the considerable, transferable skills we have built managing OXXO’s progress over the years—represents a very compelling opportunity. With this in mind, in May, we closed the acquisition of a 75% stake in Farmacias YZA, a leading regional drugstore operator with more than 300 stores in southeast Mexico. Also, in May, we completed the acquisition of Farmacias Moderna, an important drugstore operator with over 100 stores in the western state of Sinaloa. Through these transactions, we advance our strategy to play an increasingly significant role in an evolving, consolidating, and modernizing industry, where we can replicate our winning small-box retail format strategy.

Furthermore, in January 2014, FEMSA Comercio closed the acquisition of an 80% investment stake in Gorditas Doña Tota, a leading quick-service restaurant operator with a strong brand and more than 200 outlets in Mexico and the U.S. This acquisition opens another compelling new avenue for growth. Through this transaction, we will not only contribute our significant expertise in the development of small-box retail formats to what is already a successful player in the quick-service restaurant industry, but also gain relevant capabilities in the area of prepared food. Moving forward, Doña Tota will continue to operate as a stand-alone format.

Each of our 16 distribution centers aim to serve an average of approximately 800 stores, replenishing an inventory of over 1,800 products for our shoppers at least twice a week.

transactions made

nationwide every day!

Profitable Complexity

We use our robust information technology platform, detailed processes, and logistics expertise to manage the complex variables required to run an efficient supply chain profitably. Today, through our demand planning system, we are able to accurately replenish our stores with the items they need to satisfy our consumers according to the movement of goods in different product categories. To do this, we use information extracted from our point-of-sale databases, as well as historical data, to predict the behavior patterns for our product categories in the different seasons and events of the year. Together, these systems and processes significantly improve product availability, reduce stock outs, increase inventory turnover, and achieve high levels of service.

Furthermore, our 16 distribution centers use the information generated by our demand planning system to design and execute the logistics required to pick, pack, and ship products on-time for sale at our stores. Our centers each aim to serve an average of approximately 800 stores, replenishing the inventory of over 1,800 products at least twice a week through a distribution network synchronized with our warehouse operations to ensure the proper transportation and care of the product. Our centers’ operations are conducted through an advanced warehouse management system, which has developed the functionality to manage each task and control every movement of an article from receiving to shipping. Because of the importance of inventory control, we use different tools such as Radio Frequency and Voice-guided Picking to register every transaction in real-time. Moreover, the modern infrastructure of our new distribution centers enables optimal material handling and a high fill rate of orders, while minimizing the risk of any damage to our merchandise. Our centers are also capable of handling any kind of product—from dry to frozen and perishable foods.

Thanks to our efficient supply chain management, comprehensive human resources platform, and technologically advanced business model, OXXO profitably manages the complexity of more than 100,000 employees handling over 9 million transactions across a nationwide network of more than 11,700 stores each and every day.

We opened another compelling new avenue for growth with our recent acquisition of a controlling stake in Doña Tota, a strong regional player in the quick-service restaurant sector with high consumer preference in northern Mexico.