Traversing a Difficult Landscape

In the face of a tough consumer and volatile currency environment, our business produced single-digit top- and bottom-line growth. For the year, our total revenues rose 5.6% to Ps. 156.0 billion. Our gross profit grew 6.3% to Ps. 72.9 billion, and our income from operations reached Ps. 21.5 billion.

Powerade is rapidly becoming the sports drink of choice among young health-conscious consumers across our franchise territories.

Consumer Focus

Consumer-driven innovation is key to our business strategy. Through innovation, we capitalize on our agility to serve the diverse, constantly evolving preferences and practices of our more than 346 million consumers across 10 different countries each and every day.

Together with our partner, The Coca-Cola Company, in 2013, we introduced a number of new products and presentations to satisfy consumer demand in multiple beverage categories. In Buenos Aires, Argentina, we kicked off the global launch of Coca-Cola Life, a low-calorie alternative for one of the world’s most beloved brands. Sweetened with such natural ingredients as stevia and cane sugar, Coca-Cola Life offers our consumers less than half the calories of regular Coke. Launched in multiple packages, we not only achieved more than 80% coverage of our points of sale, but also gained share and revitalized the Coca-Cola category among our consumers.

We also continue to quench the thirst of health-conscious consumers of isotonic sports drinks with the innovative growth of Powerade. Through our hot fill formula, we heat Powerade almost to the point of pasteurization, eliminating the need for preservatives and achieving a better tasting product. In Mexico, Powerade is now the leading isotonic brand in three of our five operating regions, achieving 46% market share in our overall Mexican franchise by the end of 2013. Building on the brand’s popularity in Venezuela, we launched Powerade ION4, which is specially designed to help replenish fluids and minerals lost during exercise. Powerade is rapidly becoming the sports drink of choice among young people—bolstering the brand’s growth by 21% in Venezuela.

We further continue to proactively address our consumers’ evolving needs with a growing array of affordable, returnable packaging alternatives. In Brazil, we reinforced the coverage of our 2-liter multi-serve returnable PET presentation for brand Coca-Cola, enabling consumers to share the magic of Coke at home. In the Valley of Mexico, we launched our 3-liter multi-serve returnable PET presentation for brand Coca-Cola, providing an attractive value proposition for our consumers’ enjoyment. Also in the Valley of Mexico, we launched our 2.5-liter multi-serve returnable PET presentation for Sidral Mundet, expanding the opportunities to share this popular local brand. In Colombia, we reinforced the coverage of our 1.25-liter multi-serve returnable glass presentation for home consumption of brand Coca-Cola, Sprite, and Quatro. In Mexico, we reinforced the coverage of our convenient 500-milliliter returnable glass presentation for brand Coca-Cola, fostering consumption at the point of sale or at home. In Mexico, we also expanded the coverage of our 1.25-liter multi-serve returnable glass presentation for brand Coca-Cola, catering to families in our new and existing franchise territories. Through our growing portfolio of returnable presentations, we look to provide the right package at the right price for every consumer.

Constant Growth

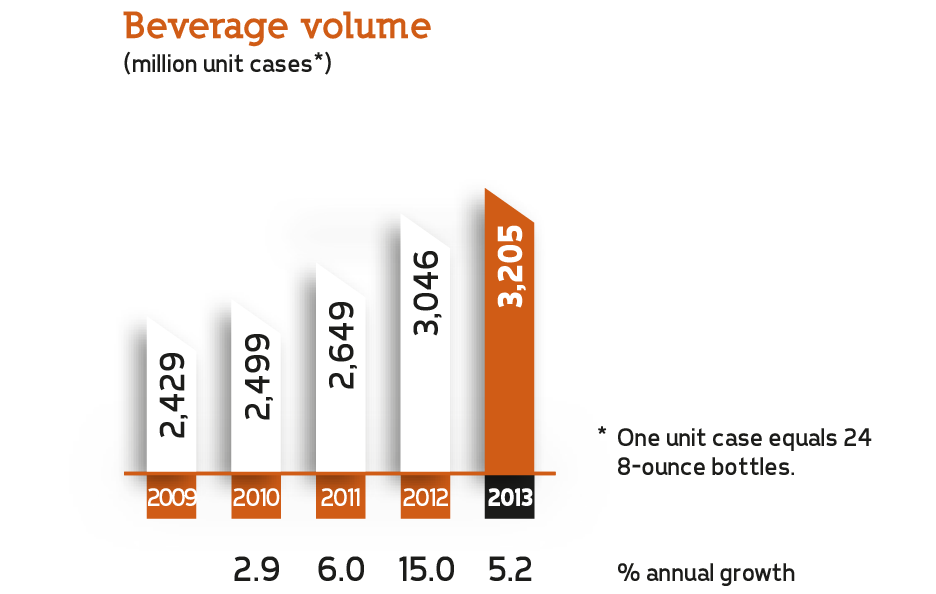

Despite a very difficult operating environment, we generated solid currency-neutral organic growth. Excluding the non-comparable results from our mergers with Grupo Fomento Queretano and Grupo Yoli in Mexico and our acquisitions of Companhia Fluminense and Spaipa in Brazil, our currency-neutral revenues rose 16.3%. The main drivers of our performance for the year were our reinforced marketplace execution and ability to adapt our wide portfolio of beverages to capture different consumption occasions and satisfy consumers’ demand, while capitalizing on the realities of our geographically diversified portfolio of franchise territories.

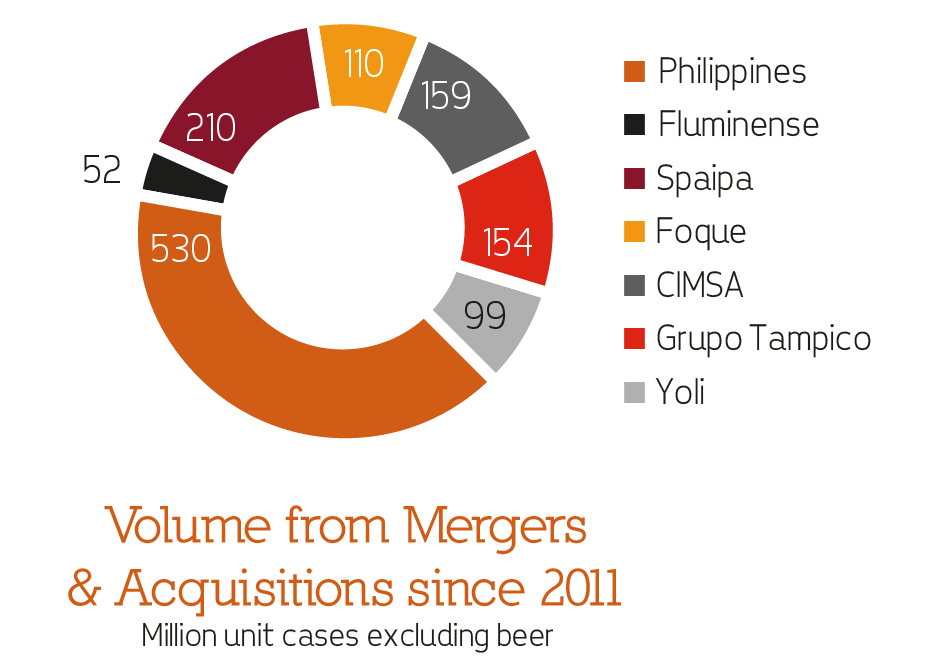

As previously reported, in January 2013, we closed the acquisition of 51% of Coca-Cola Bottlers Philippines, Inc., The Coca-Cola Company’s bottling operations in the Philippines. This transaction represents an important strategic expansion of our company’s bottling footprint beyond Latin America—reinforcing our exposure to fast growing economies and our commitment to The Coca-Cola System. With one of the highest per capita consumption rates of Coca-Cola products in the region, the Philippines presents significant opportunities for further growth.

We continue to focus on the opportunities that the Latin American Coca-Cola bottling system presents. Accordingly, we completed two important acquisitions that consolidate our company’s leadership position in Brazil—one of the top five markets in terms of volume for The Coca-Cola Company worldwide. These acquisitions not only highlight the long-term strategic importance of the Brazilian market for Coca-Cola FEMSA, but also confirm our conviction in the country’s attractive domestic consumption prospects and socioeconomic dynamics.

First, we closed the acquisition of 100% of Companhia Fluminense in August. This franchise serves 5 million consumers across parts of the states of Minas Gerais, Rio de Janeiro, and São Paulo. It provides a perfect geographic link between our São Paulo and Minas Gerais territories, creating opportunities to multiply strategic alliances with customers and suppliers, generate greater value from our combined scale, and capture upwardly revised synergies of approximately US$19 million.

Second, in October, we closed the acquisition of 100% of Spaipa, the second largest privately owned bottler in the Brazilian Coca-Cola system. This franchise serves close to 17 million consumers across the states of Paraná and São Paulo. It offers an ideal geographic fit with our operations in the states of Mato Grosso do Sul and São Paulo, facilitating a smooth integration and the generation of potential synergies of approximately US$33 million.

Together, these transactions increase our volume in Brazil by close to 55%, reaching 39% of the Coca-Cola system’s volume in the country. They also enable us to increase the number of consumers we serve in Brazil by approximately 50% to 72 million—more than the number of consumers that we serve in Mexico.

We continue to adapt our broad portfolio of beverages to capture different consumption occasions and satisfy consumer demand across our geographically diverse franchise territories.

growth in our

Brazilian operations

with our two recent

acquisitions.

Profitable Complexity

Throughout the year, we have worked with our partner, The Coca-Cola Company, and a talented team of local professionals to transform our complex operations in the Philippines.

Among our strategic initiatives, we implemented more than 120 training cells to develop the core and functional capabilities of our executives in the Philippines. We streamlined our portfolio of products and presentations, delisting approximately 20% of our SKUs, while focusing on the fastest moving SKU’s. Across the greater Manila metropolitan area, we launched “Mismo,” an exceptionally popular 300-milliliter, single-serve, one-way PET presentation for on-the-go consumption of brand Coca-Cola at 10 Philippine pesos, and successfully re-launched “Kasalo,” a well-received 750-milliliter, multi-serve, returnable glass presentation for shared consumption of brand Coca-Cola, Sprite, and Royal. We also launched our refreshing new Minute Maid orangeade in an affordable 250-milliliter, single-serve presentation that appeals to Filipino consumers’ palates and pocketbooks. We further rolled out a new route to market at the six distribution centers serving the greater Manila metropolitan area with encouraging results from both our clients and local delivery partners. Additionally, we optimized our production and distribution network, while modernizing our capacity to introduce new products and presentations into the market. Through this comprehensive strategy, we are firmly on the path to long-term profitability.

Looking forward, the investments that we have made in every one of our franchise territories provide us with a strong foundation to take advantage of the short- to medium-term recovery of our markets. The skills of our team, the strength of our multi-category beverage portfolio, and the breadth of our geographically diverse footprint should enable us to deliver sustainable value for our stakeholders.