FEMSA’s mission is to create economic and social value through business enterprises and institutions. This includes consistently attracting and meeting consumer demand, generating financial returns for our shareholders and promoting higher social growth.

Our 2017 financial results reflect the economic value we continue to create in the countries where FEMSA operates.

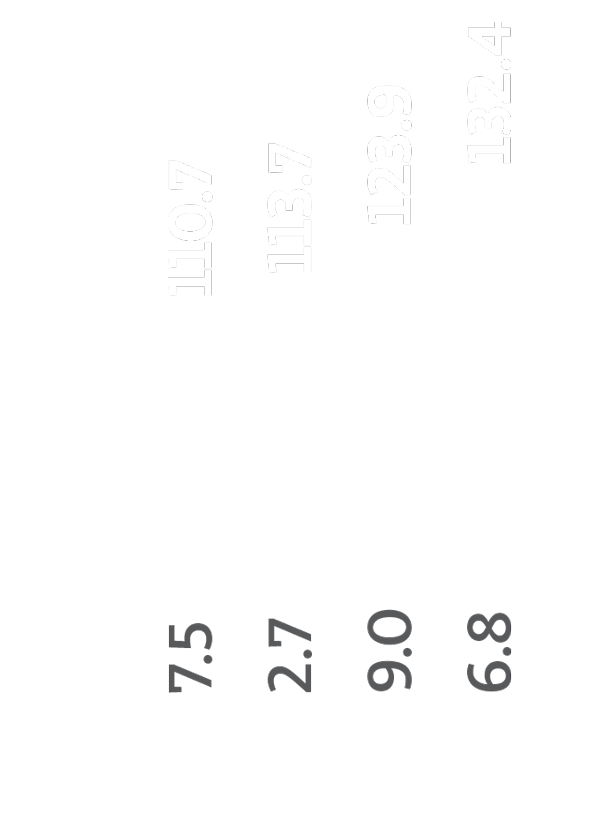

| Millions of pesos | 2017(1) | 2017 | 2016 | %Change | 2015 | %Change |

|---|---|---|---|---|---|---|

| Total revenues | 23,445 | 460,456 | 399,507 | 15.3% | 311,589 | 28.2% |

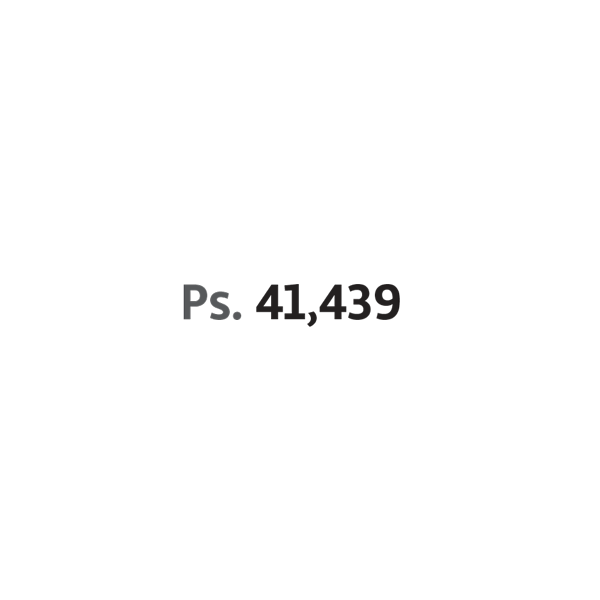

| Income from operations (2) | 2,110 | 41,439 | 37,427 | 10.7% | 33,735 | 10.9% |

| Operating margin | 9.0% | 9.4% | 10.8% | |||

| Consolidated net income | 1,895 | 37,206 | 27,175 | 36.9% | 23,276 | 16.8% |

| Controlling interest net income (3) | 2,160 | 42,408 | 21,140 | 100.6% | 17,683 | 19.5% |

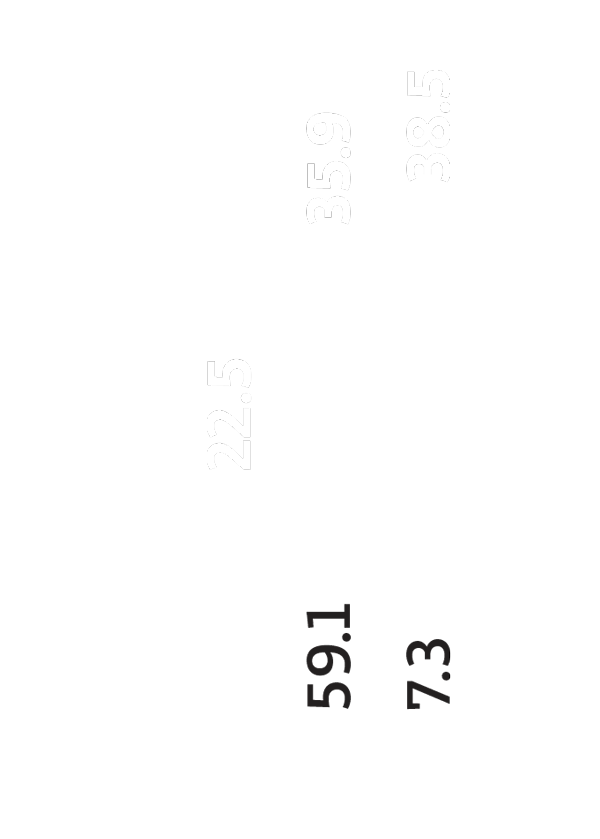

| Controlling interest earnings per BD unit (4) | 0.6 | 11.9 | 5.9 | 101.7% | 4.9 | 20.4% |

| Controlling interest earnings per ADS (5) | 6.0 | 118.5 | 59.1 | 100.5% | 49.4 | 19.6% |

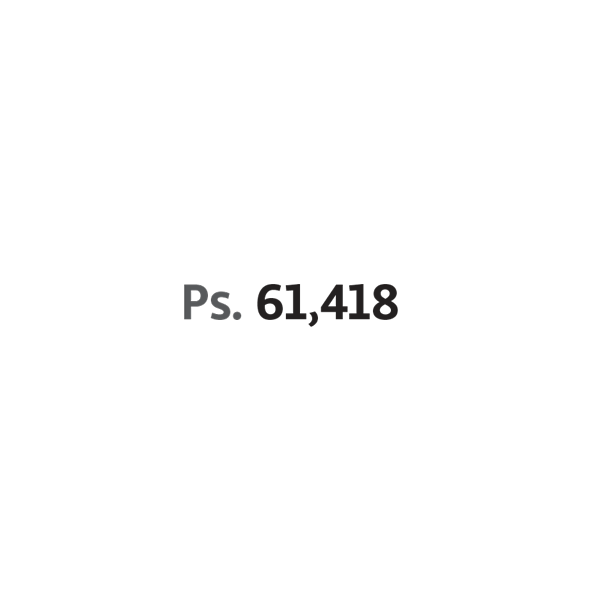

| EBITDA | 3,127 | 61,418 | 54,987 | 11.7% | 46,626 | 17.9% |

| EBITDA margin | 13.3% | 13.8% | 15.0% | |||

| Total assets | 29,967 | 588,541 | 545,623 | 7.9% | 409,332 | 33.3% |

| Total liabilities | 12,812 | 251,629 | 259,453 | -3.0% | 167,476 | 54.9% |

| Total equity | 17,155 | 336,912 | 286,170 | 17.7% | 241,856 | 18.3% |

| Capital expenditures | 1,282 | 25,180 | 22,155 | 13.7% | 18,885 | 17.3% |

| Total cash and cash equivalents (6) | 4,936 | 96,944 | 43,637 | 122.2% | 29,396 | 48.4% |

| Short-term debt | 692 | 13,590 | 7,281 | 86.7% | 5,895 | 23.5% |

| Long-term debt | 5,996 | 117,758 | 131,967 | -10.8% | 85,969 | 53.5% |

| Headcount (7) | 295,027 | 266,144 | 10.9% | 246,158 | 8.1% |

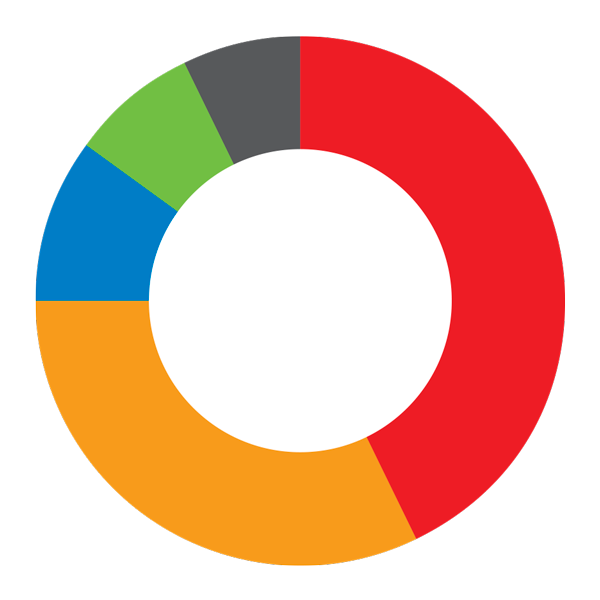

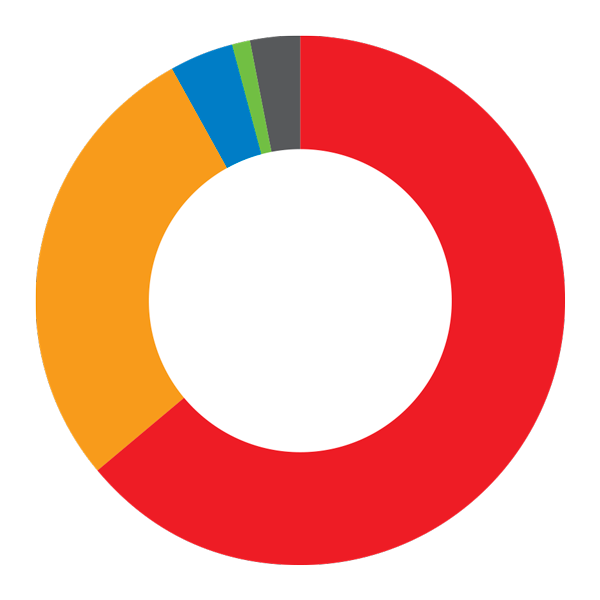

Total Revenues

by Business Unit

millions of Mexican pesos

| Coca-Cola FEMSA | 43% | |

|---|---|---|

| FEMSA Comercio: | ||

| Retail Division | 32% | |

| Health Division | 10% | |

| Fuel Division | 8% | |

| Others* | 7% |

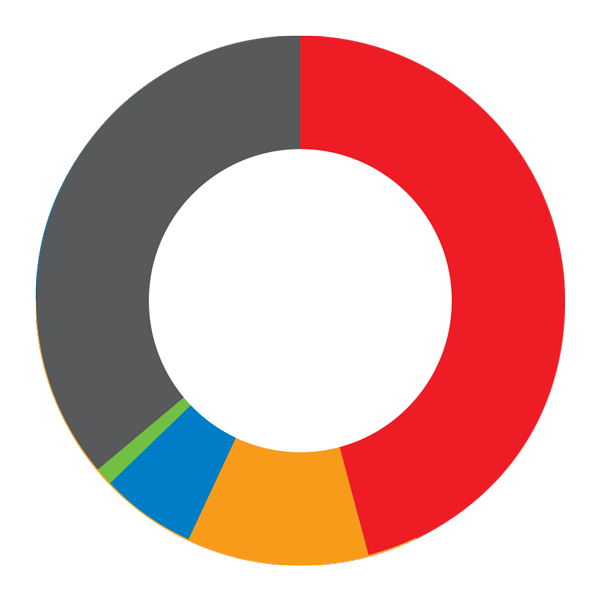

Total Assets

by Business Unit

millions of Mexican pesos

| Coca-Cola FEMSA | 46% | |

|---|---|---|

| FEMSA Comercio: | ||

| Retail Division | 11% | |

| Health Division | 6% | |

| Fuel Division | 1% | |

| Others* | 36% |

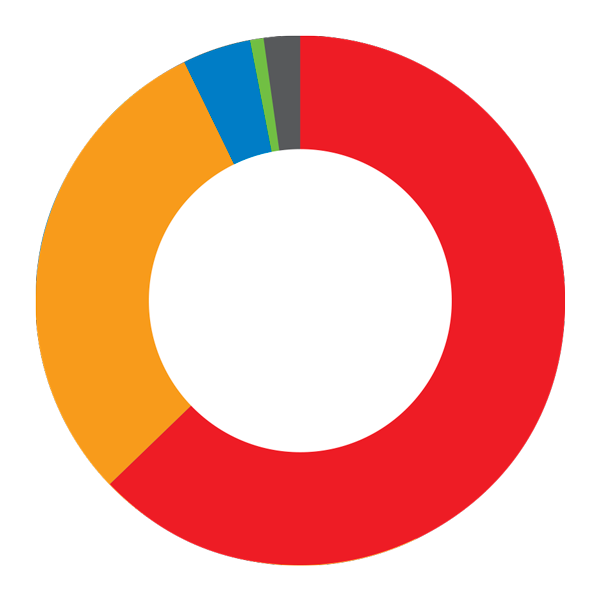

Income from Operations

by Business Unit 1

millions of Mexican pesos

| Coca-Cola FEMSA | 63% | |

|---|---|---|

| FEMSA Comercio: | ||

| Retail Division | 30% | |

| Health Division | 4% | |

| Fuel Division | 1% | |

| Others* | 2% |

EBITDA 2

by Business Unit

millions of Mexican pesos

| Coca-Cola FEMSA | 64% | |

|---|---|---|

| FEMSA Comercio: | ||

| Retail Division | 28% | |

| Health Division | 4% | |

| Fuel Division | 1% | |

| Others* | 3% |

Headcount

thousands

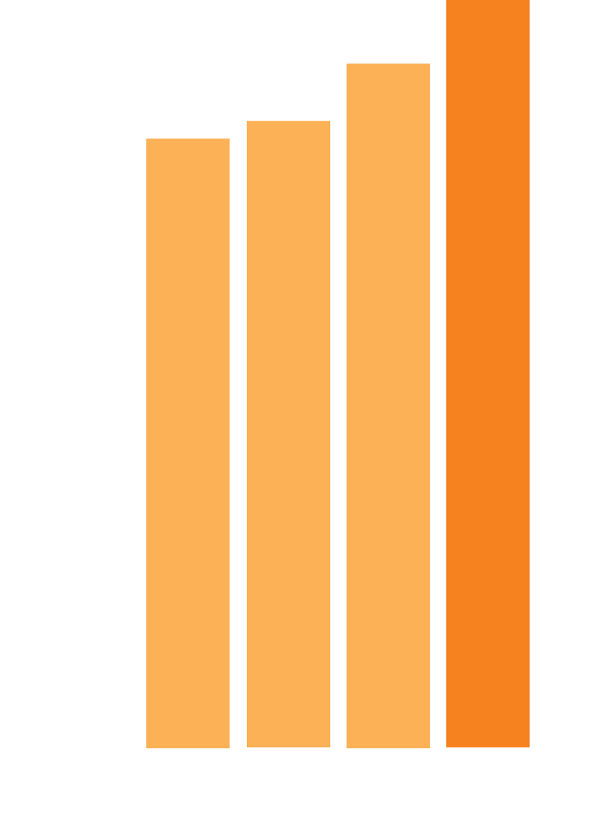

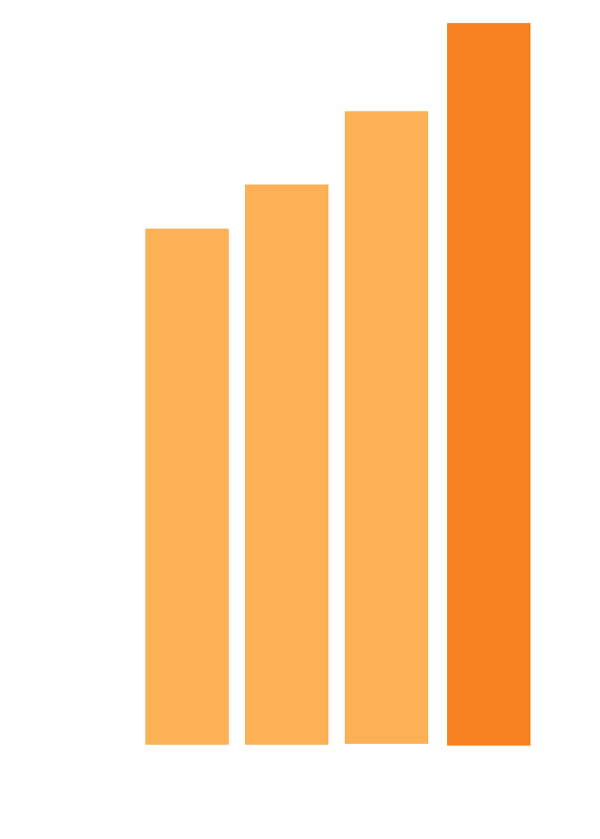

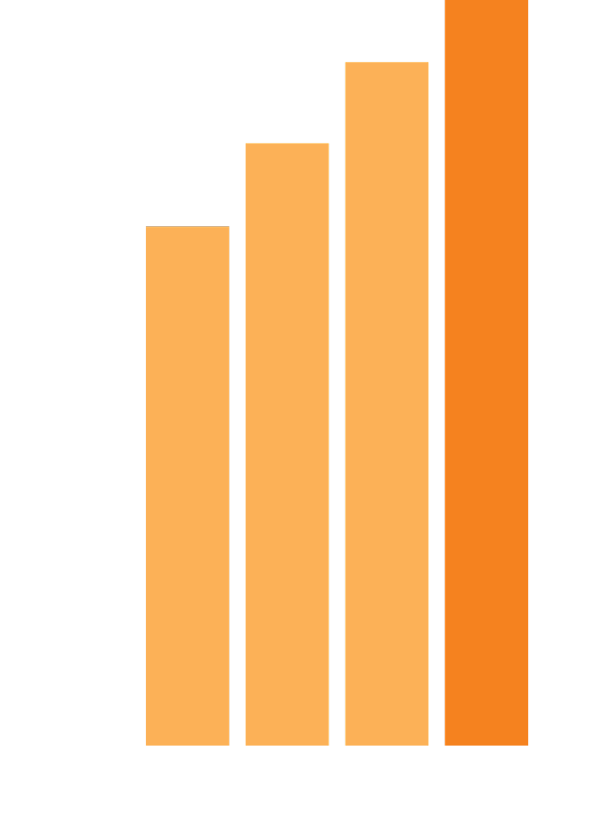

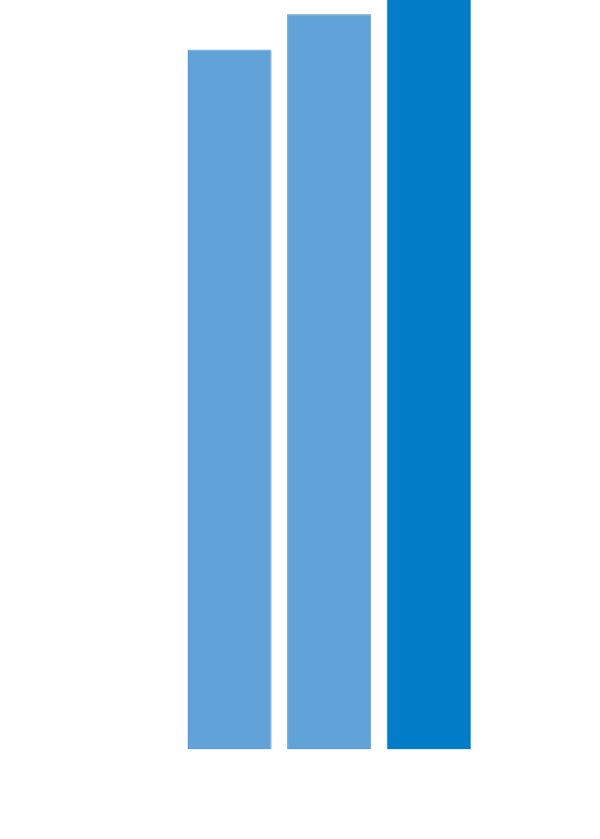

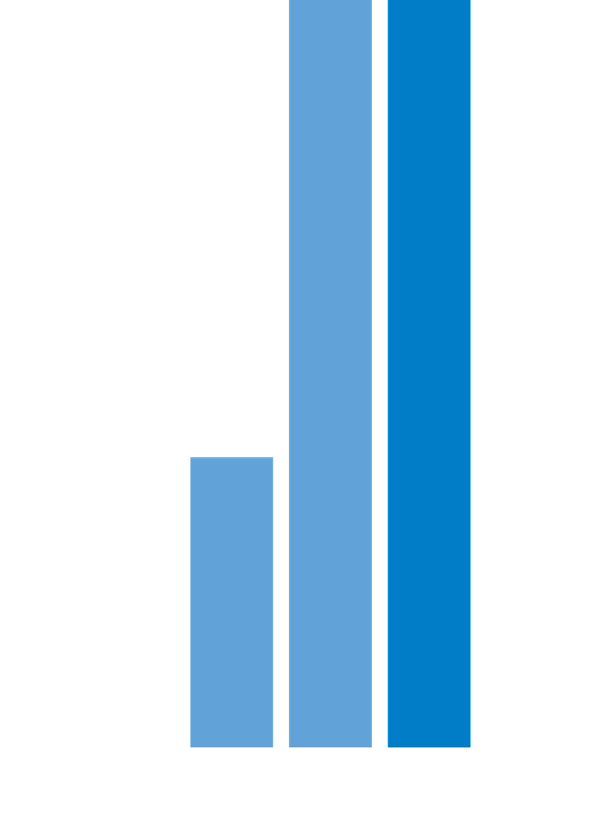

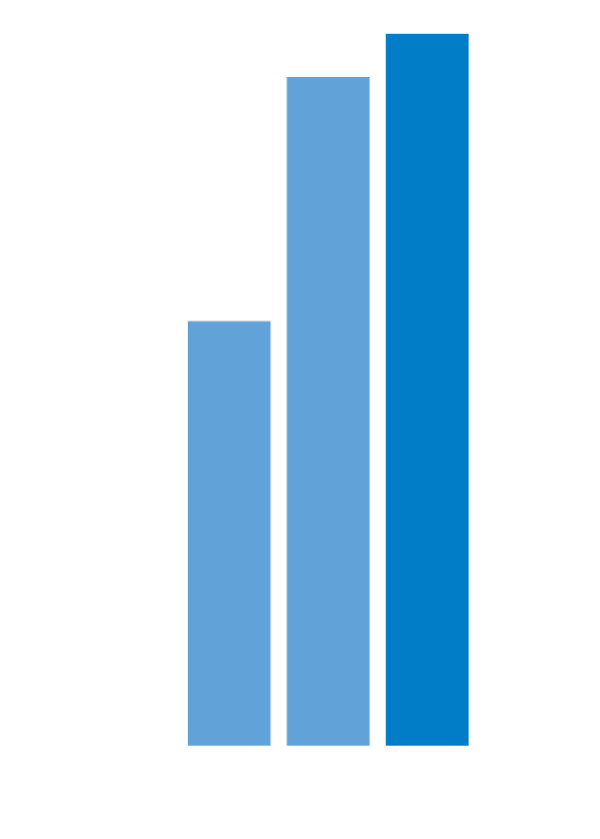

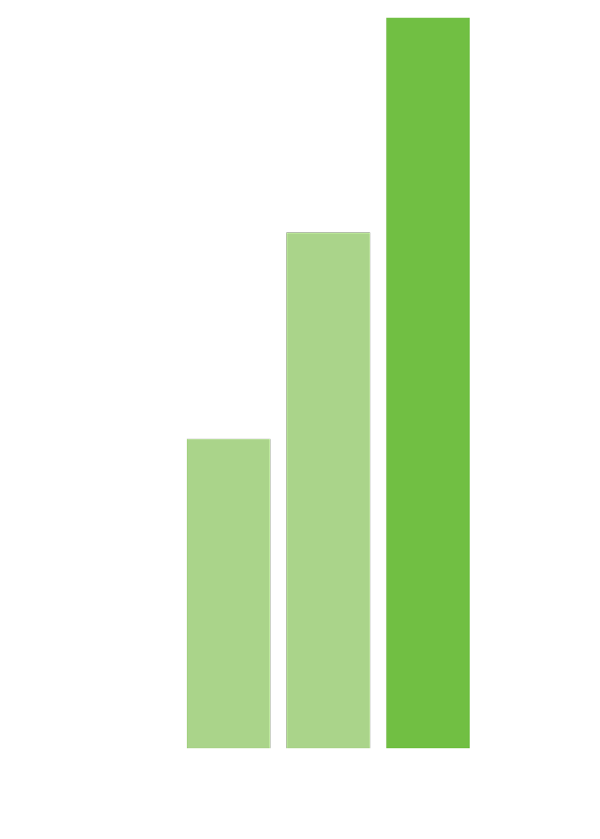

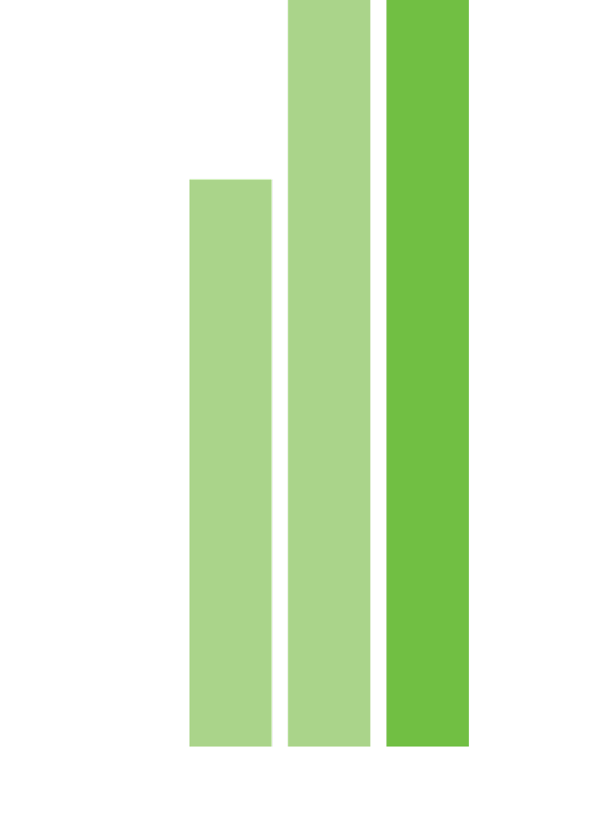

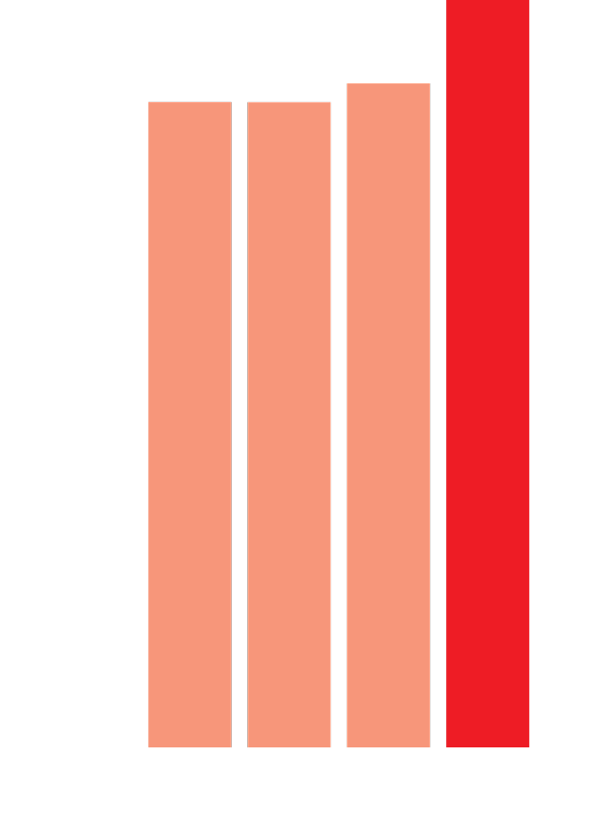

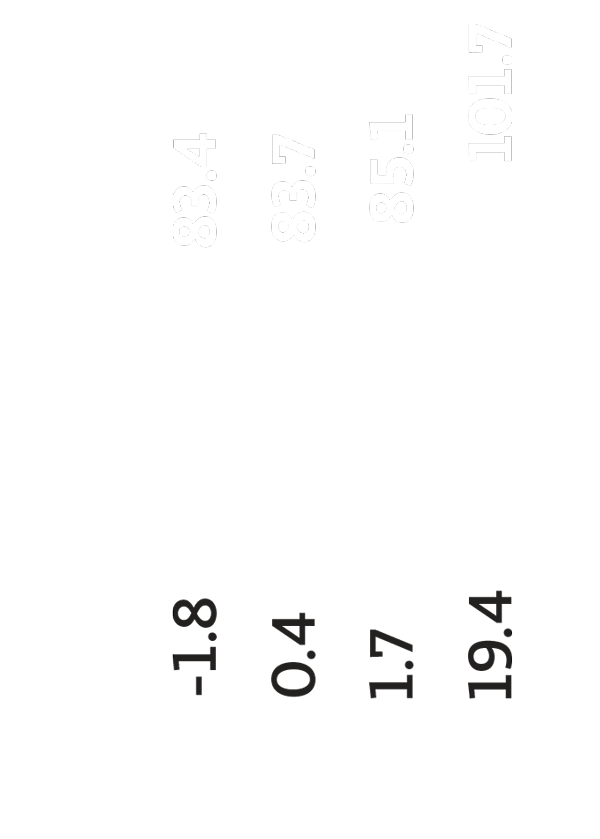

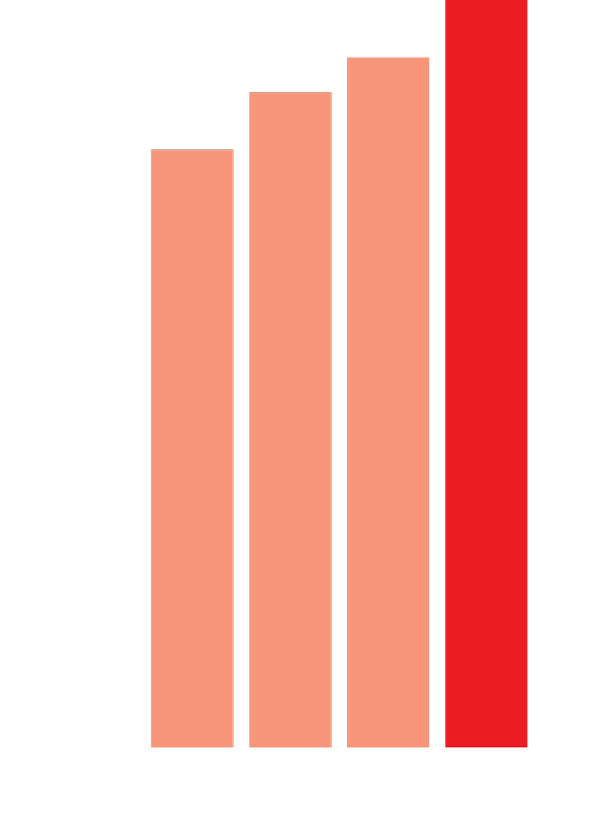

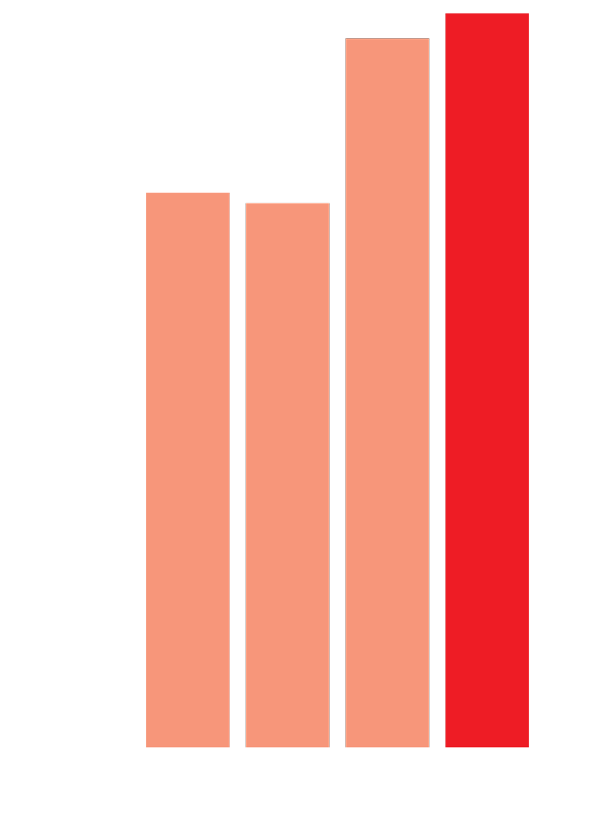

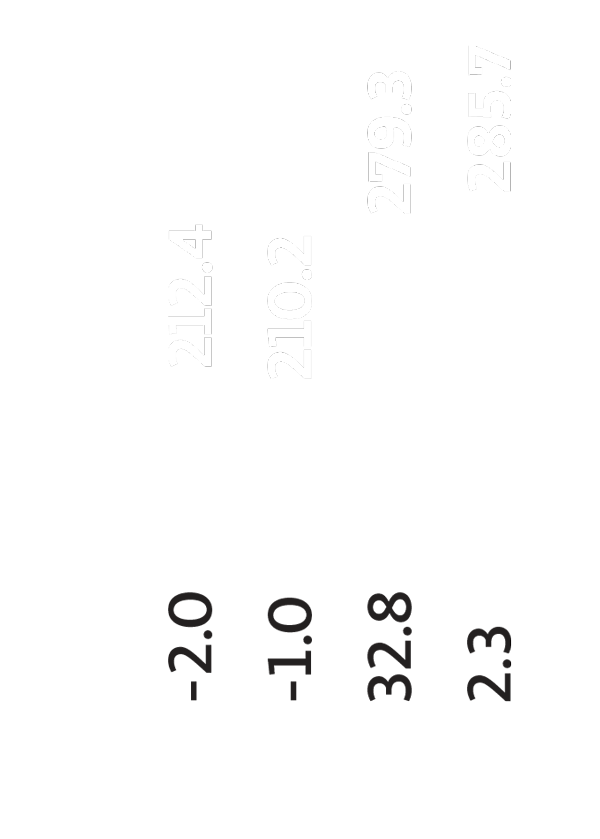

Total Revenues

billions of Mexican pesos

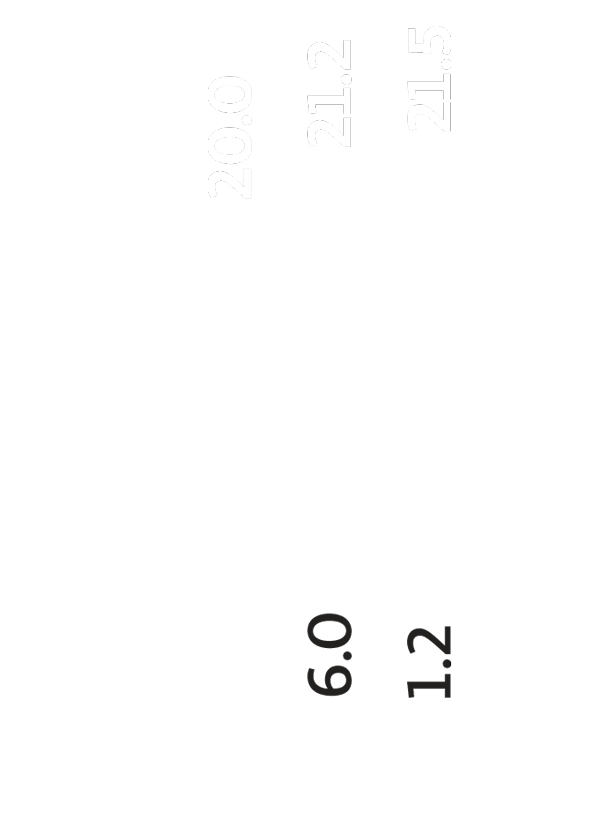

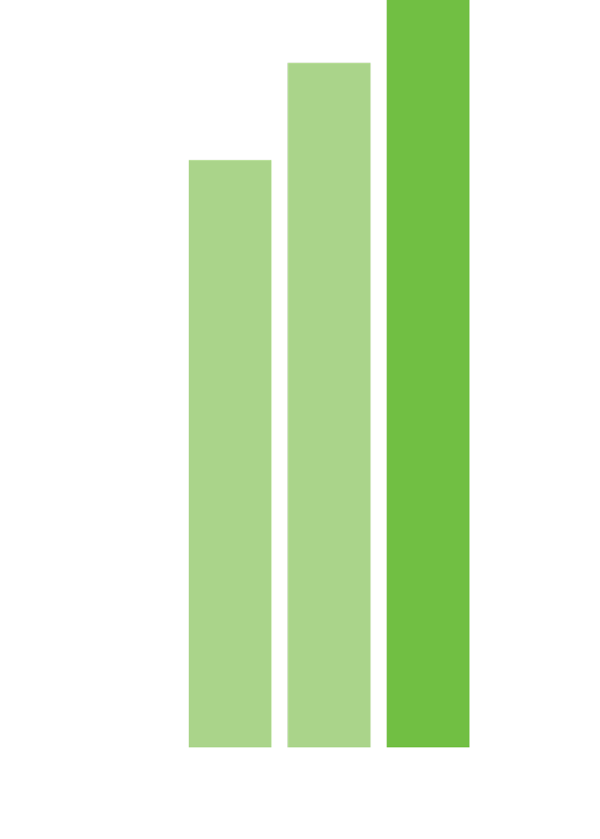

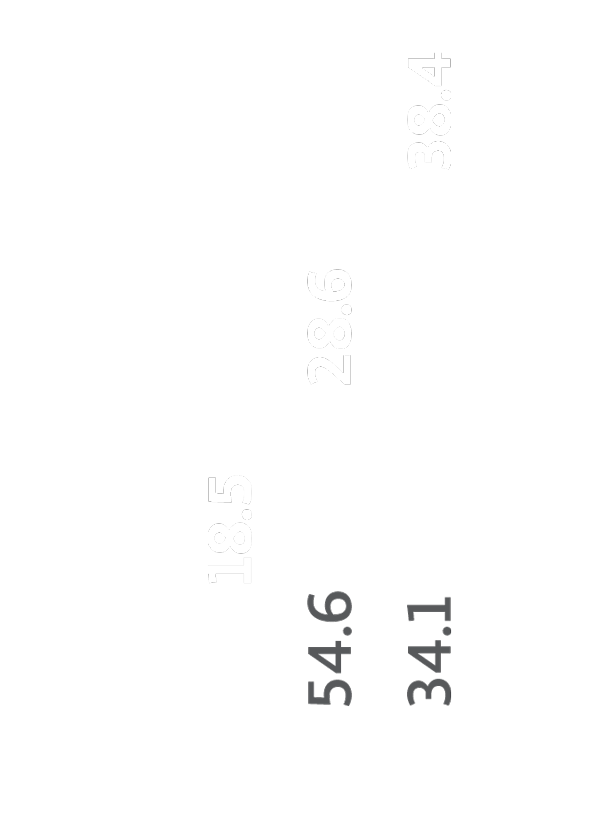

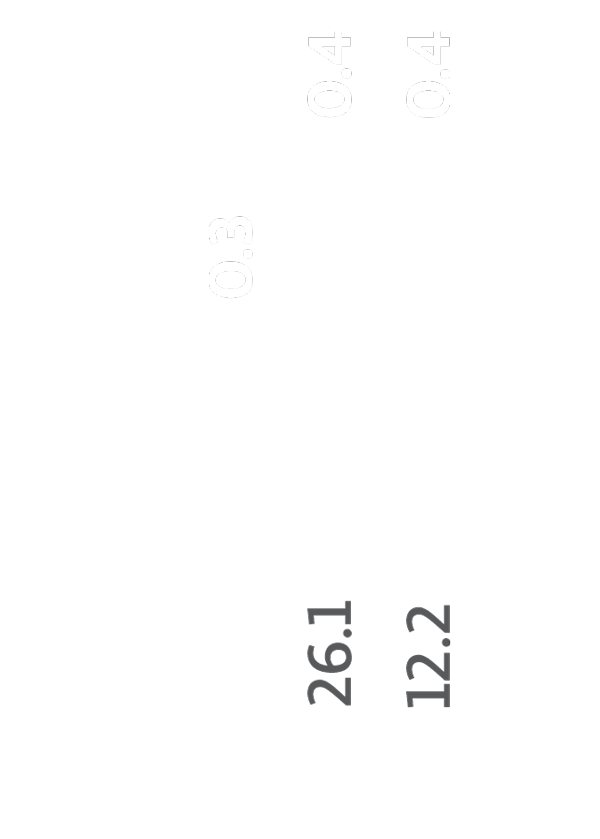

Income from Operations1

billions of Mexican pesos

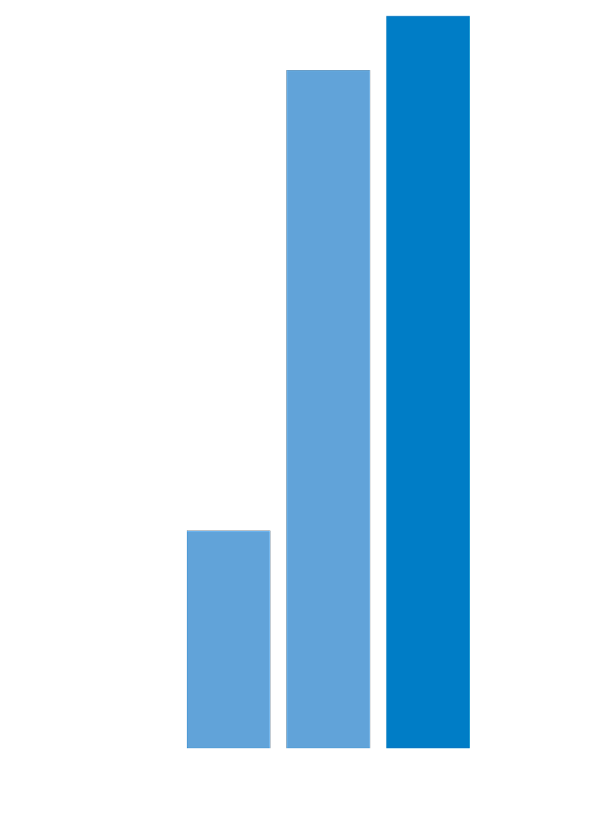

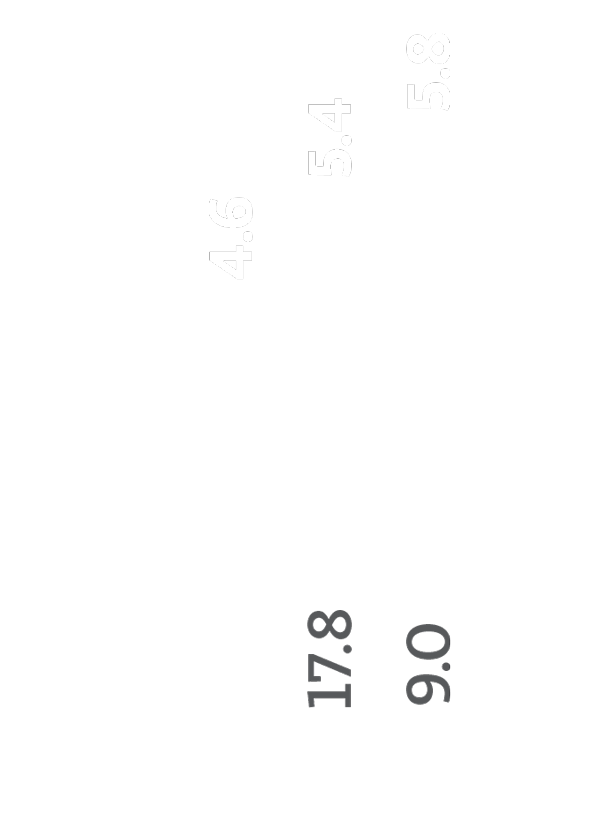

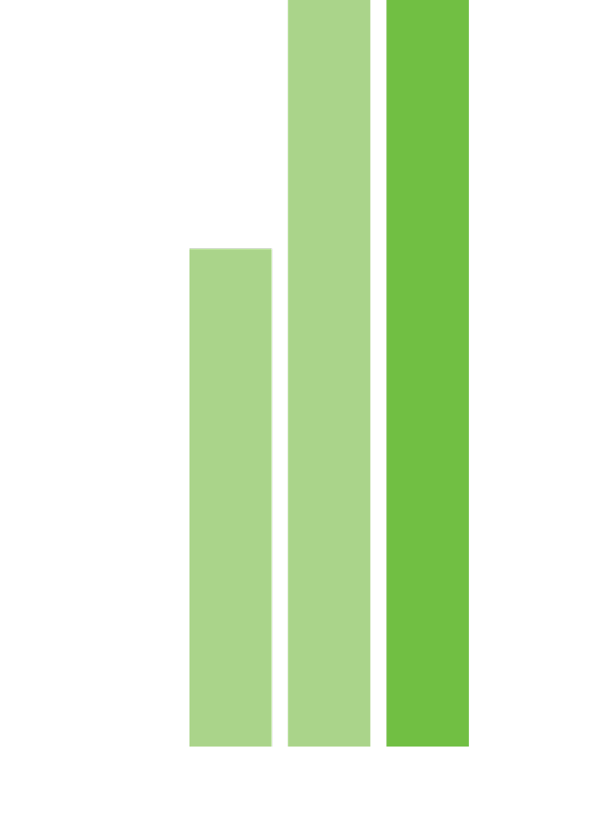

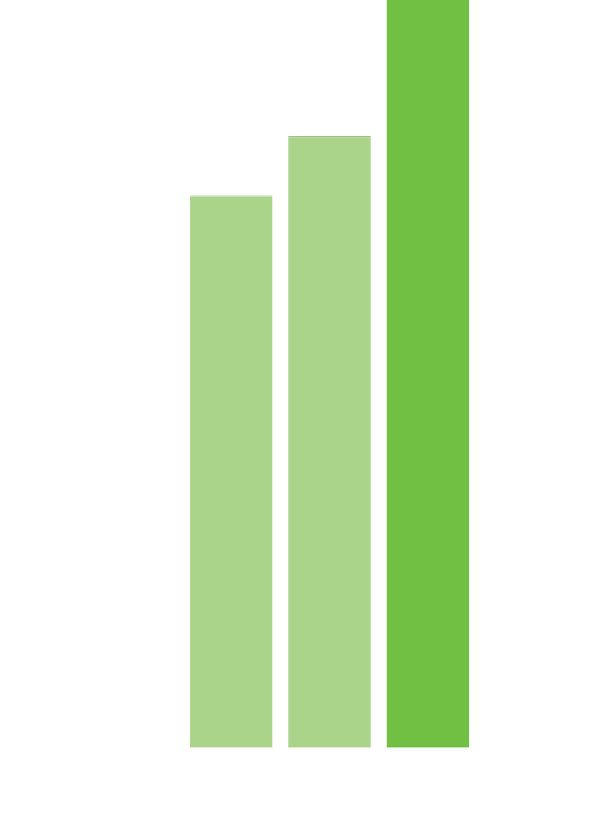

EBITDA2

billions of Mexican pesos

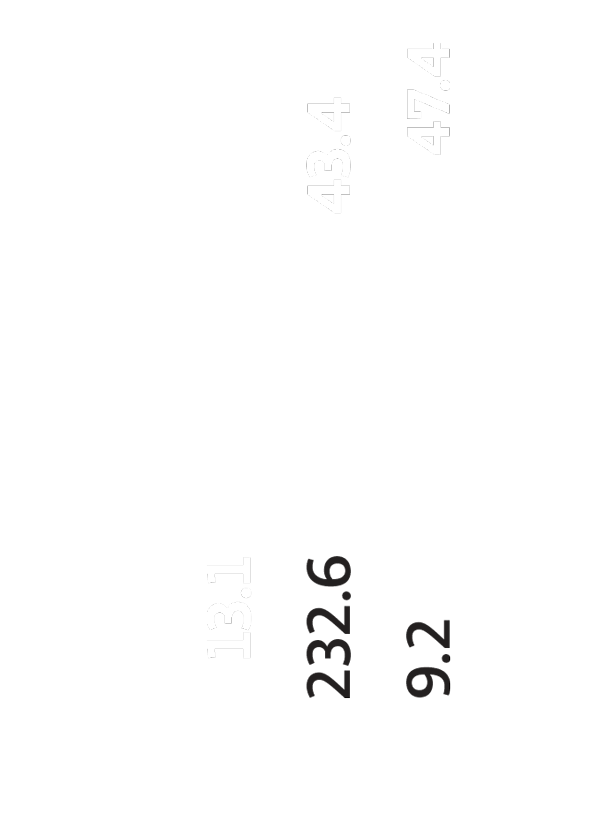

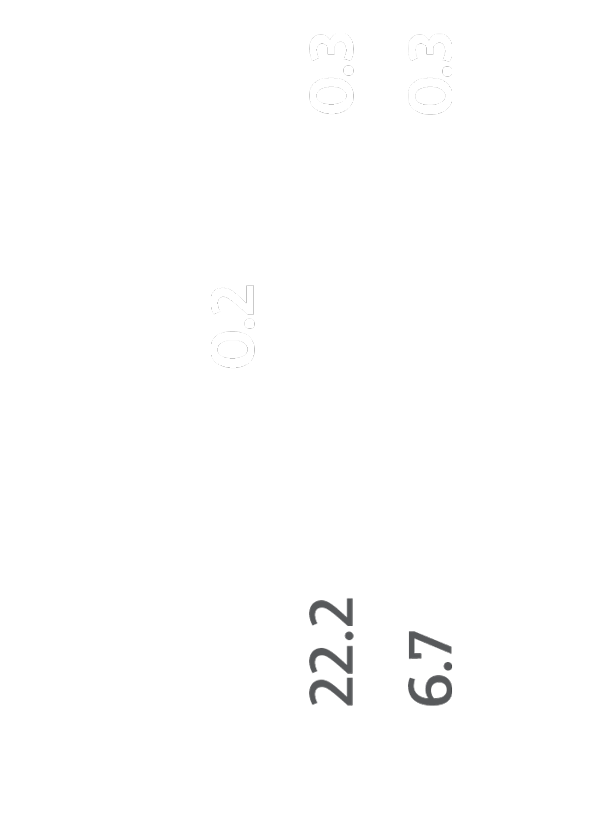

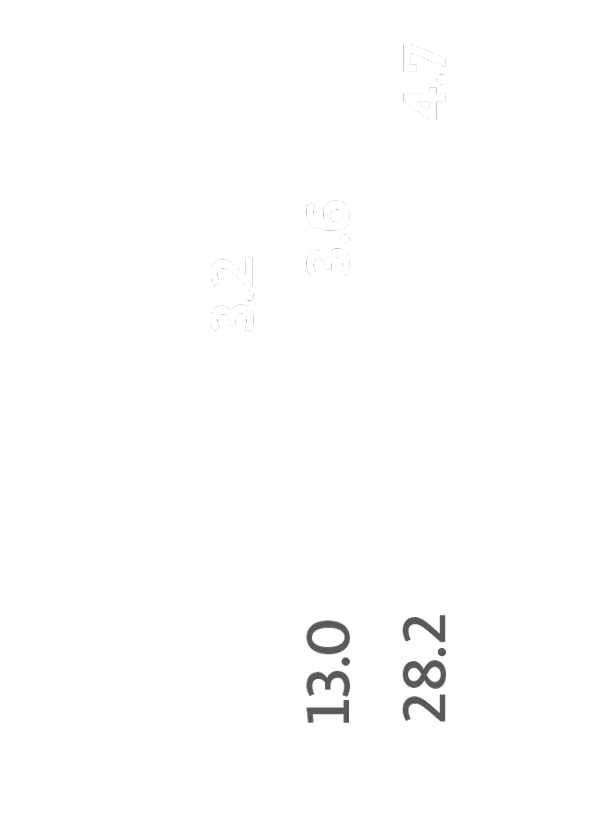

Total Assets

billions of Mexican pesos

Headcount

thousands

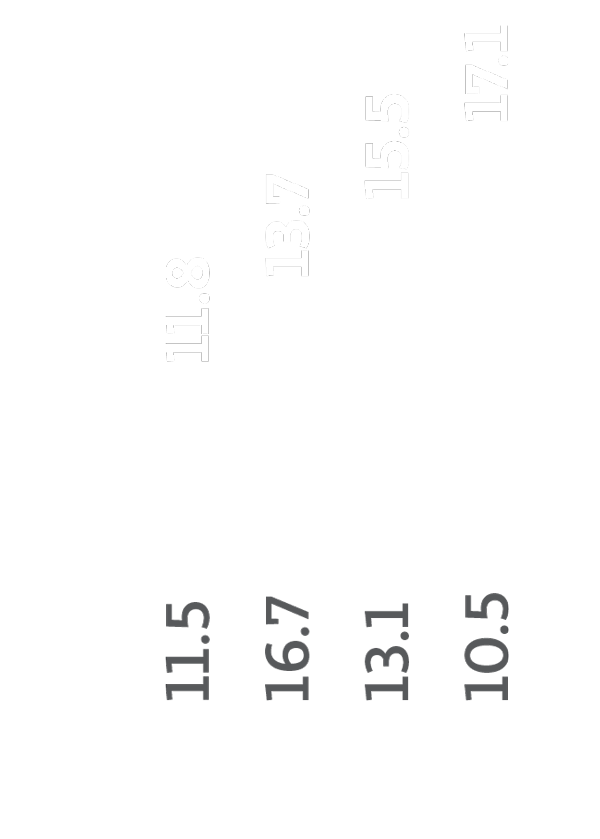

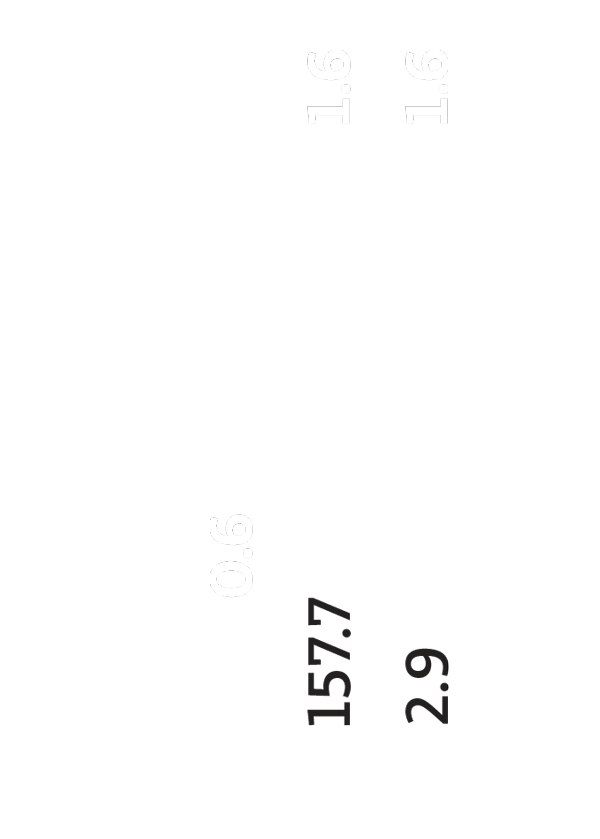

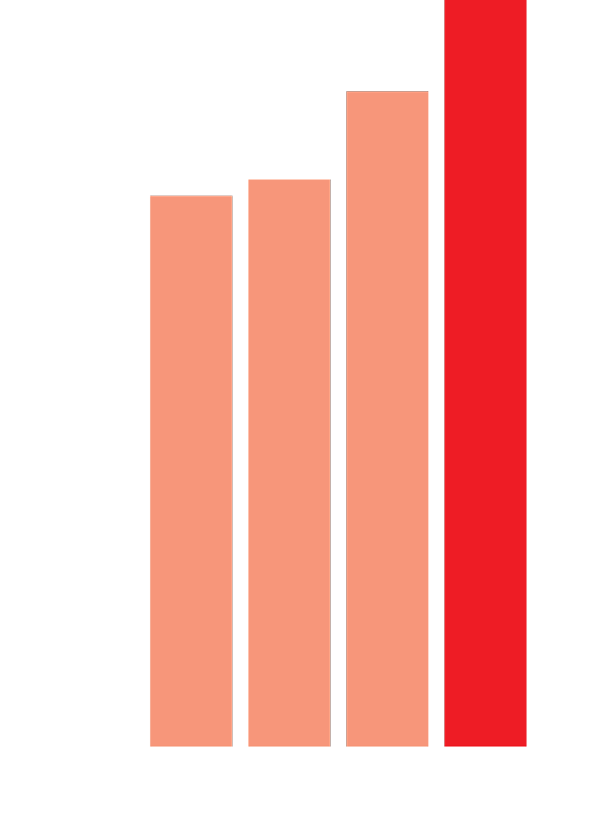

Total Revenues

billions of Mexican pesos

Income from Operations1

billions of Mexican pesos

EBITDA2

billions of Mexican pesos

Total Assets

billions of Mexican pesos

Headcount

thousands

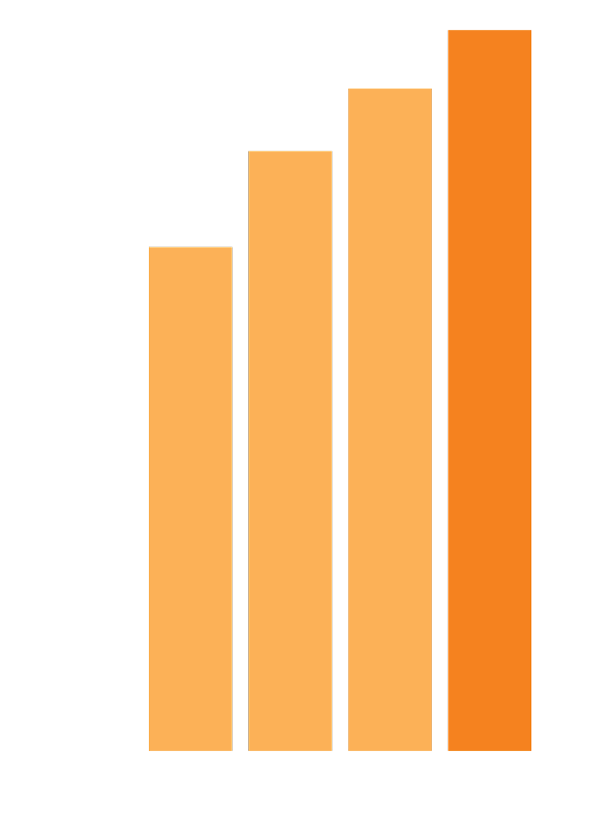

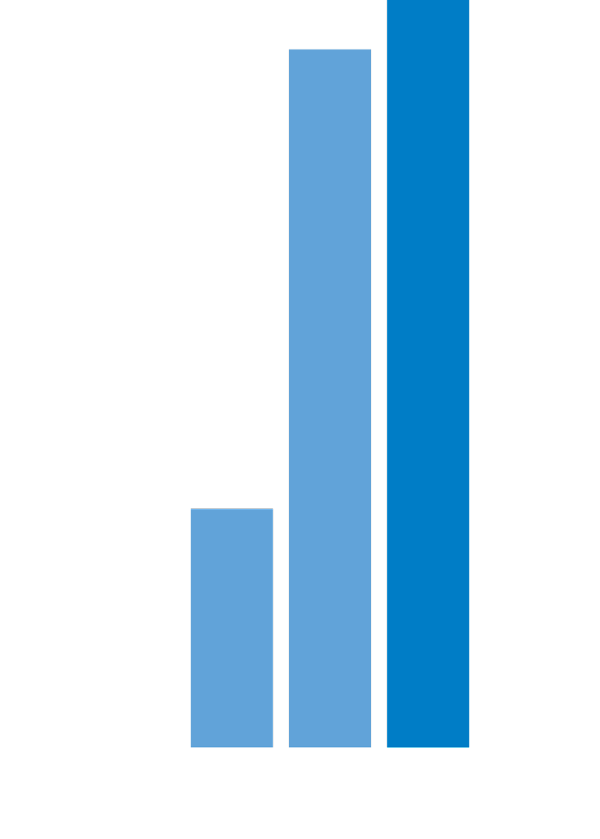

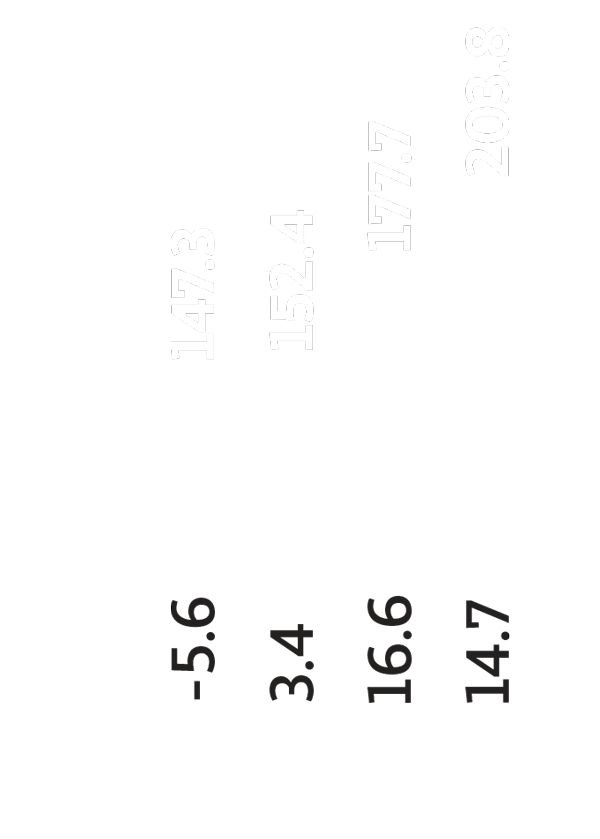

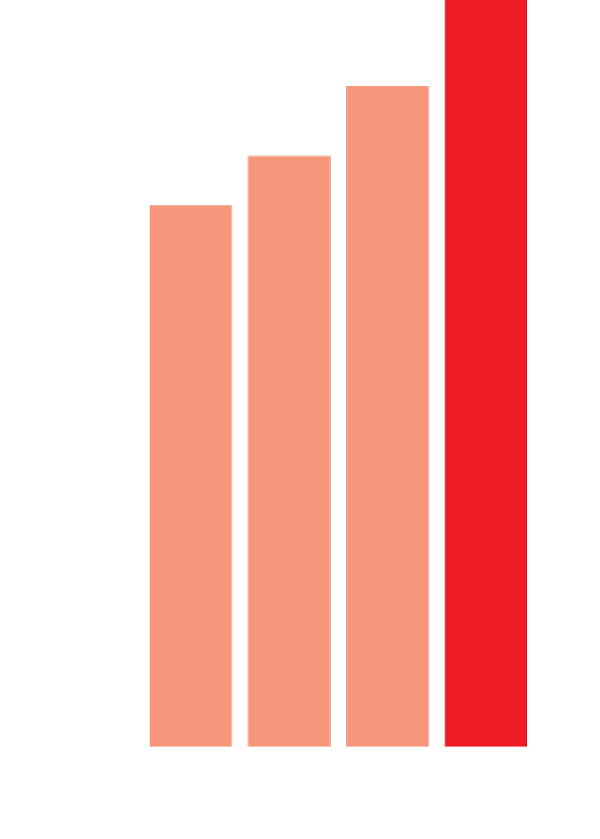

Total Revenues

billions of Mexican pesos

Income from Operations1

billions of Mexican pesos

EBITDA2

billions of Mexican pesos

Total Assets

billions of Mexican pesos

Headcount*

thousands

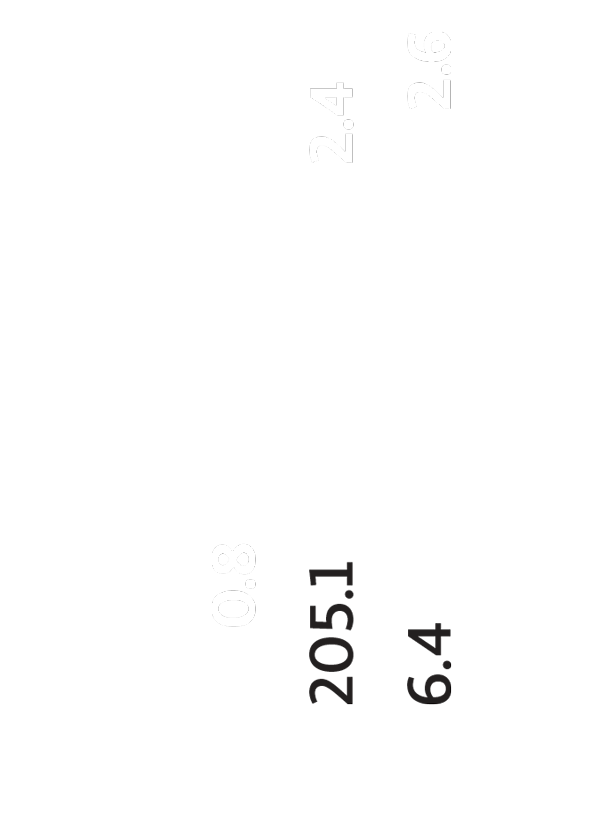

Total Revenues

billions of Mexican pesos

Income from Operations1

billions of Mexican pesos

EBITDA2

billions of Mexican pesos

Total Assets

billions of Mexican pesos

We create value for our stakeholders not only through successful economic performance, but also by generating the social, environmental and economic conditions necessary to operate today and to grow sustainably over time. In 2017, we continued to more fully integrate sustainability into our business strategy.

| 2017 | 2016 | 2015 | ||

|---|---|---|---|---|

|

Average hours of training per employee | 33.92 | 25.60 | 26.60 |

| Accident Index 1 | 2.10 | 2.13 | 3.94 | |

| Organizational Climate Result 2 | 80.80 | 81.50 | 81.40 | |

|

Energy Intensity (Gigajoules / Total Revenues in Ps. million) |

41.26 | 40.46 | 53.01 |

| Greenhouse gas emissions intensity (Tons of equivalent CO2 / Total Revenues in Ps. million) |

3.36 | 3.59 | 5.33 | |

| Water efficiency (liters of water used per liter of beverage produced) |

1.65 | 1.72 | 1.79 | |

|

Economic spill to the community 3 |

Ps. 253.2 billion US$ 12.8 billion |

Ps. 258.2 billion US$ 12.5 billion |

Ps. 184.4 billion US$ 10.7 billion |

| Percentage of procurement budget on local suppliers 4 | 87% | 82% | 85% | |

| Direct beneficiaries of FEMSA Foundation programs 5 | 1,248,123 | 1,124,319 | 631,250 | |

|

||||

Our integrated Annual Report 2017, reflects our solid corporate governance and transparency.