The past decade of strong, steady growth in our FEMSA Comercio retail operations has helped to position our company to continue delivering value to our stakeholders in the coming years. FEMSA Comercio contributed 50 percent of FEMSA’s consolidated revenues in 2017 (up from 38 percent in 2007) and contributed 33 percent of EBITDA in 2017 (up from 18 percent in 2007), reflecting an increasingly balanced core portfolio over time and favorably diversifying our financial performance. Despite rising inflation in Mexico, the rapid transformation of Mexico’s fuel industry, and a number of severe natural disasters in 2017, our retail operations made solid progress in a resilient consumer environment and are well positioned to continue creating value and driving long-term earnings growth.

Retail Division

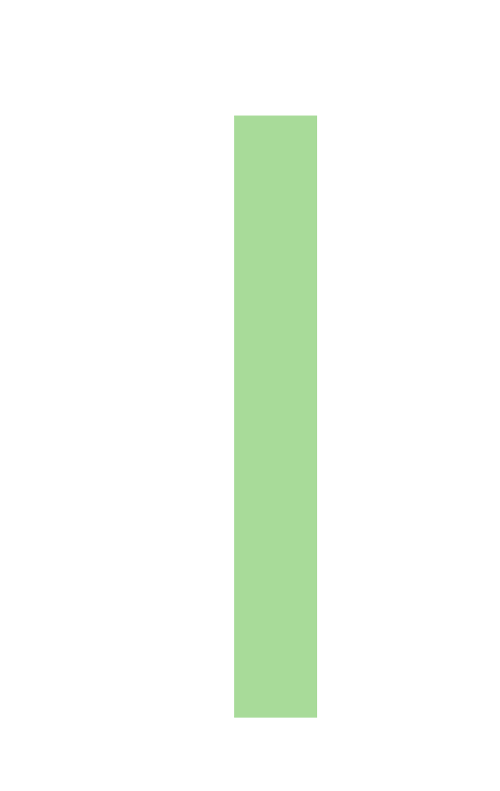

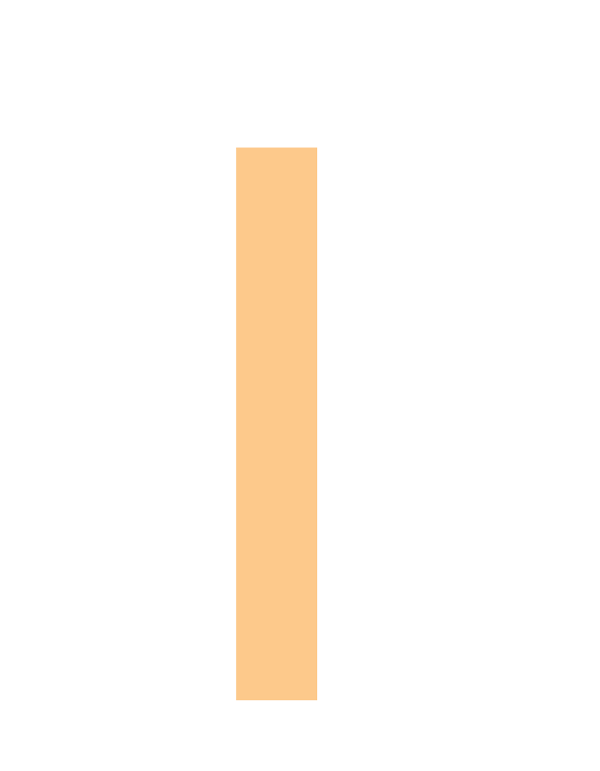

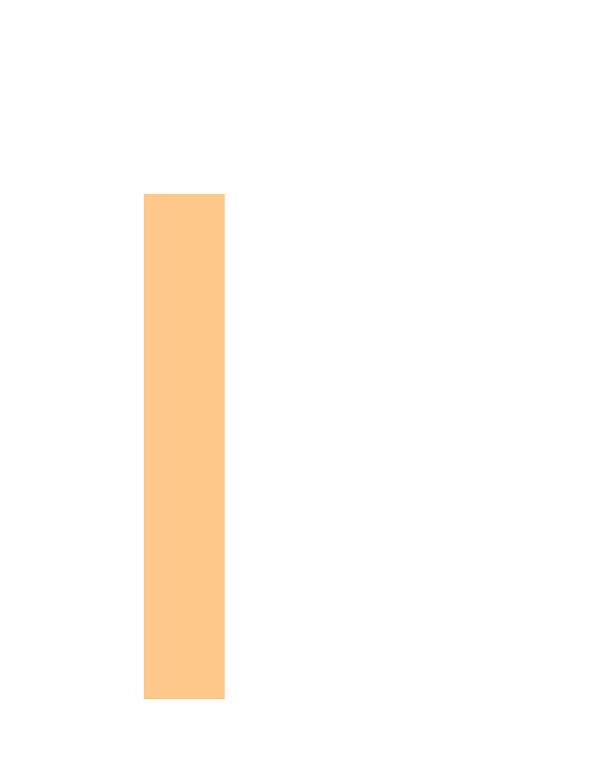

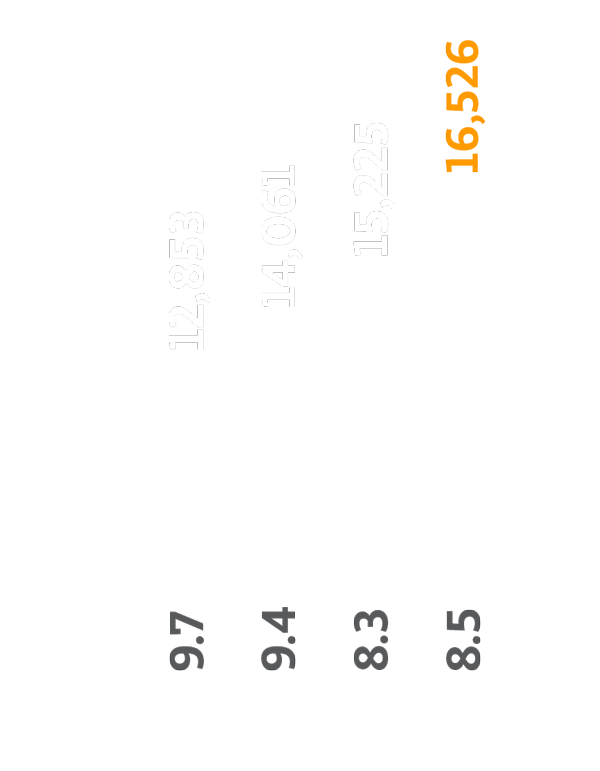

Every day, nearly 12 million people make a purchase at one of our more than 16,500 OXXO proximity retail stores in Mexico and Colombia. With a strong brand and best-in-class margins and returns, OXXO is the third-largest retailer in Mexico in terms of revenues and the largest store chain in the Americas by units. We saw revenue growth in the Retail Division of 12.4 percent by year-end 2017.

Trajectory for success

On average, the Retail Division opens one new OXXO store every seven hours. In 2017, we again added new stores at an accelerated pace, opening a record of 1,301 net new stores—and creating approximately 10,000 direct new jobs in the process—while maintaining above-trend growth in same-store sales for the third year in a row.

Our trajectory for continued growth remains very strong in many regions of Mexico where store penetration remains relatively low. We have developed proprietary models to assist in identifying optimal store locations, store formats, and product categories. We expect to continue to generate solid returns in new stores by strictly monitoring our cost-of-capital parameters and by consistently implementing our proven operating processes and practices.

In 2017, we also continued to prepare for long-term growth and expansion of the OXXO brand beyond Mexico. In our stores in Colombia and Chile, we are deploying our considerable expertise in the convenience-store format while optimizing our local value proposition and understanding of how best to serve our consumers across markets. Gaining this knowledge will help support the next stage of potential expansions to other regional markets in South America.

Expanding convenience

Driving the sustained growth of the OXXO brand is FEMSA’s dedicated focus on creating value for stakeholders while refining our business model and offerings to meet the market’s needs. Consumers who have relied on OXXO to quench their thirst, satisfy a snack craving or pick up a prepared meal now increasingly appreciate the one-stop convenience of purchasing other products or using essential services while at one of our stores. For example, providing a place to securely make deposits and withdrawals from bank accounts, receive remittances from relatives living abroad, and pay utility bills are ways our company is investing in the social and relationship capital of our customers to earn their trust.

In turn, these added service offerings are driving same-store traffic growth and expanding the gross margin. In 2017, our Correspondent Banking network included 12 partner banking institutions, and the number of issued Saldazo debit card accounts reached more than 9 million.

To ensure that we maintain a motivated workforce, we are also making investments in the human capital of our organization. We are taking steps to ensure that our OXXO employees are working in stores closer to their home, thereby saving them time and money, while potentially contributing to a reduction in traffic congestion and greenhouse gas emissions related to commuting. In 2017, we also took steps to increase compensation, training, and diversity among our OXXO employees as part of our plan for employee engagement and retention. Though these new policies and investments in human capital partially contributed to a slight contraction of OXXO’s operating margin in 2017, we believe that our value-centered approach will reduce turnover and related costs of hiring and training in the longer term.

Spotlight on Sustainability: FEMSA is focused on reducing waste in our retail operations and supporting our community. Two examples of our efforts to accomplish this include:

Spotlight on Sustainability: FEMSA is focused on reducing waste in our retail operations and supporting our community. Two examples of our efforts to accomplish this include:

Health Division

With acquisitions in key markets over the past several years, FEMSA continues to build a strong presence in the health and drugstore segment in Latin America. We first entered this market segment in 2013, with the acquisition of two regional drugstore chains in Mexico. In 2015, we expanded further with two additional acquisitions, including a majority stake in the Chilean pharmacy and distribution chain, Grupo Socofar, which operates an integrated platform in Chile and Colombia.

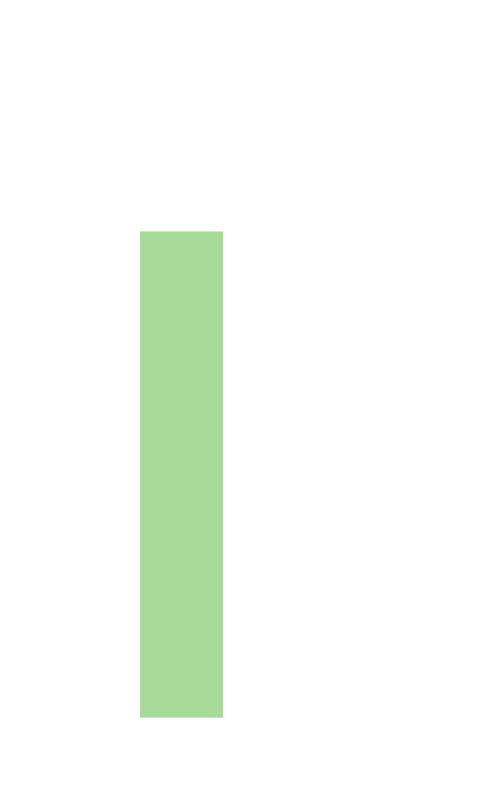

Our current growth strategy for the Health Division is to further consolidate our market presence and facilitate continued international expansion by leveraging both our effective small-box retail processes and our operational and logistics expertise. With 2,225 points of sale as of year-end 2017, we are becoming a key drugstore operator in Latin America. Revenues increased by 9.2 percent during the year, with same-store sales increasing by 6.7 percent.

Our current growth strategy for the Health Division is to further consolidate our market presence and facilitate continued international expansion by leveraging both our effective small-box retail processes and our operational and logistics expertise. With 2,225 points of sale as of year-end 2017, we are becoming a key drugstore operator in Latin America. Revenues increased by 9.2 percent during the year, with same-store sales increasing by 6.7 percent.

Strengthening our position

In Mexico, we currently operate more than 1,100 drugstores under different leading regional brands. In 2017, we continued to make significant preparations for future growth and consolidation by building the infrastructure that is required to integrate our legacy drugstore operations into a single platform and to standardize our business model across these different regional brands.

In South America, through Grupo Socofar, we operate more than 700 Cruz Verde pharmacies and 181 Maicao beauty stores in Chile, as well as more than 200 Cruz Verde drugstores in Colombia. Our Chilean operations have a solid competitive position, best-in-class operating practices and significant vertical integration. Our experience in this market has greatly expanded our knowledge base, and this represents an ideal platform from which to grow and puts us in a strong position for future regional expansion.

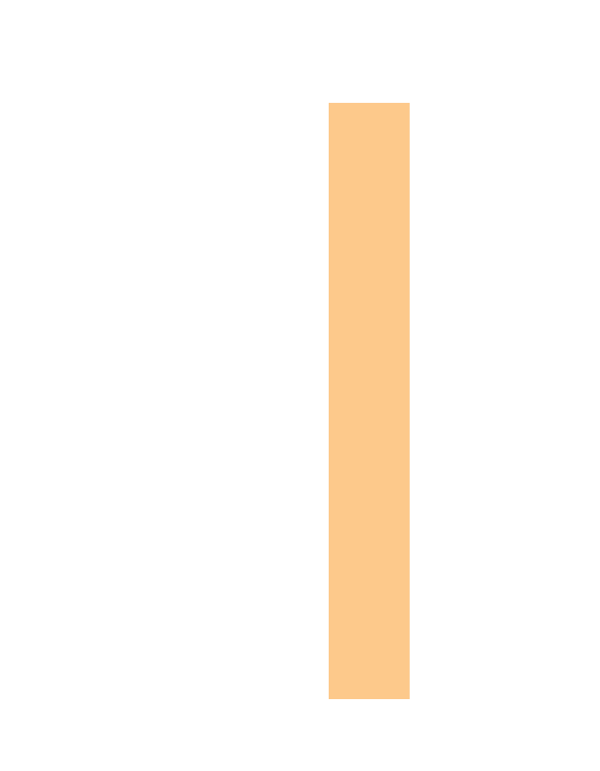

Fuel Division

Following Mexico’s historic energy reform program beginning in December 2013—which opened the oil and gas market to foreign capital for the first time in more than 75 years—FEMSA recognized the unique opportunity to participate in the transformation of the country’s fuel industry through the operation of a large network of service stations. Beginning in March 2015, we started transitioning from our legacy operation of approximately 200 service stations on behalf of third parties, to growing our own base of stations mainly through long-term lease agreements. We saw clear alignment in this endeavor with our retail service expertise, as well as the opportunity to leverage OXXO’s brand equity.

Expanding our service stations network

Expanding our service stations network

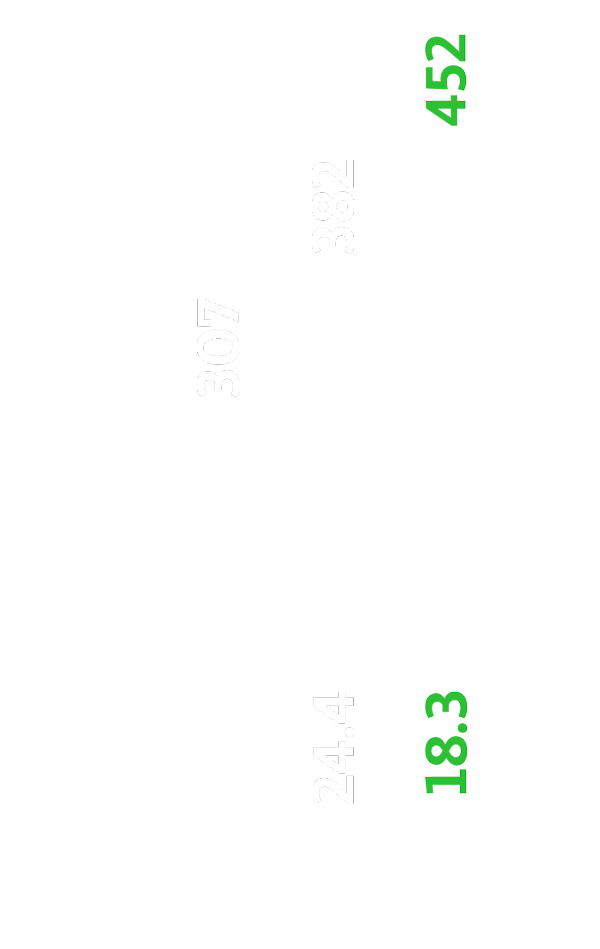

To further consolidate our presence in the market and create additional value for shareholders, in 2017 we invested in the expansion of our infrastructure and continued to roll out our OXXO GAS branding to new stations. As of the end of 2017, our Fuel Division now operates a total of 452 OXXO GAS service stations.

Our OXXO GAS outlets build trust with customers through reliable, high-quality service backed by our strong brand. We also engender loyalty through special promotions available only to our customers.

Navigating market pressures

The number of vehicles on Mexico’s roads has grown steadily over the last few decades and, with it, demand for gasoline. Domestic refining output has not kept pace with demand, and gasoline imports have increased as a result. That fact, combined with the currency conditions present in early 2017—namely a steep depreciation of the Mexican peso vis à vis the U.S. dollar—contributed to a sharp increase in the price of gasoline and diesel in January 2017 by an average of approximately 17 percent.

This unique set of circumstances led to a contraction in gross margin in the Fuel Division in the first two quarters of 2017, with gross profits per liter remaining relatively flat versus the previous year, in peso terms. In the second half, we saw stronger sequential improvement in profitability due to more flexible pricing structures and a stronger exchange rate. For the full year, revenues increased 34.1 percent, with same-station sales growth of 19.8 percent.

This unique set of circumstances led to a contraction in gross margin in the Fuel Division in the first two quarters of 2017, with gross profits per liter remaining relatively flat versus the previous year, in peso terms. In the second half, we saw stronger sequential improvement in profitability due to more flexible pricing structures and a stronger exchange rate. For the full year, revenues increased 34.1 percent, with same-station sales growth of 19.8 percent.

Looking ahead, as the oil and gas industry continues to transition to an open-market model, we will remain focused on improving our customer value proposition, expanding our network of service stations and enhancing underlying profitability by fine-tuning our business model and revenue management capabilities in ways that highlight our strengths and expertise in retail dynamics.

Spotlight on Sustainability: We are continually working to find efficiencies and save resources at our OXXO GAS service stations:

Spotlight on Sustainability: We are continually working to find efficiencies and save resources at our OXXO GAS service stations: