Financial

| Millions of pesos | 2016 (1) | 2016 | 2015 | %Change | 2014 | %Change |

|---|---|---|---|---|---|---|

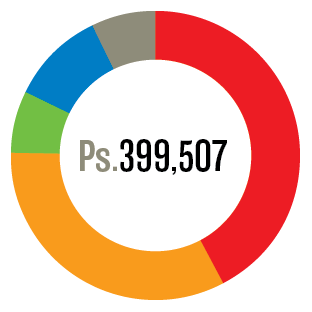

| Total revenues | 19,377 | 399,507 | 311,589 | 28.2% | 263,449 | 18.3% |

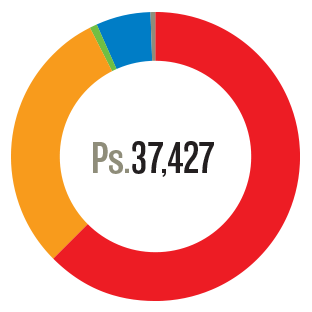

| Income from operations (2) | 1,815 | 37,427 | 33,735 | 10.9% | 29,983 | 12.5% |

| Operating margin | 9.4% | 10.8% | 11.4% | |||

| Consolidated net income | 1,318 | 27,175 | 23,276 | 16.8% | 22,630 | 2.9% |

| Controlling interest net income (3) | 1,025 | 21,140 | 17,683 | 19.5% | 16,701 | 5.9% |

| Controlling interest earnings per BD unit (4) | 0.3 | 5.9 | 4.9 | 20.4% | 4.7 | 4.3% |

| Controlling interest earnings per ADS (5) | 2.9 | 59.1 | 49.4 | 19.6% | 46.7 | 5.8% |

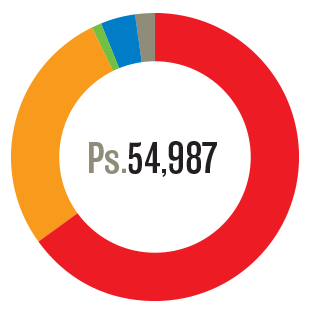

| EBITDA | 2,667 | 54,987 | 46,626 | 17.9% | 40,945 | 13.9% |

| EBITDA margin | 13.8% | 15.0% | 15.5% | |||

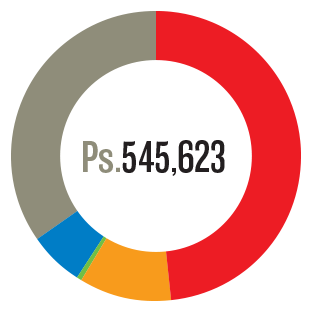

| Total assets | 26,465 | 545,623 | 409,332 | 33.3% | 376,173 | 8.8% |

| Total liabilities | 12,584 | 259,453 | 167,476 | 54.9% | 146,051 | 14.7% |

| Total equity | 13,880 | 286,170 | 241,856 | 18.3% | 230,122 | 5.1% |

| Capital expenditures | 1,075 | 22,155 | 18,885 | 17.3% | 18,163 | 4.0% |

| Total cash and cash equivalents (6) | 2,117 | 43,637 | 29,396 | 48.4% | 35,497 | -17.2% |

| Short-term debt | 353 | 7,281 | 5,895 | 23.5% | 1,553 | 279.6% |

| Long-term debt | 6,401 | 131,967 | 85,969 | 53.5% | 82,935 | 3.7% |

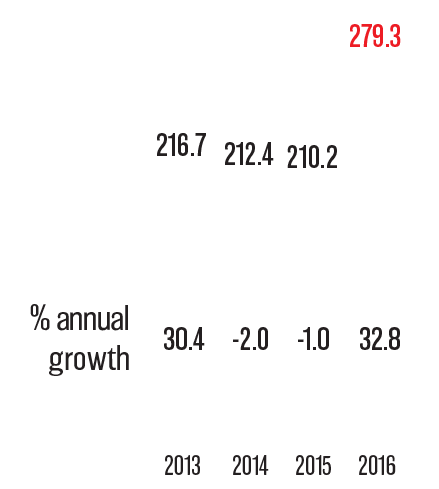

| Headcount (7) | 266,144 | 246,158 | 8.1% | 216,740 | 13.6% |

| Coca-Cola FEMSA | 43% | |

|---|---|---|

| FEMSA Comercio: | ||

| Retail Division | 33% | |

| Fuel Division | 7% | |

| Health Division | 10% | |

| Others8 | 7% |

| Coca-Cola FEMSA | 48% | |

|---|---|---|

| FEMSA Comercio: | ||

| Retail Division | 10% | |

| Fuel Division | 1% | |

| Health Division | 6% | |

| Others8 | 35% |

| Coca-Cola FEMSA | 64% | |

|---|---|---|

| FEMSA Comercio: | ||

| Retail Division | 31% | |

| Fuel Division | 0.5% | |

| Health Division | 4% | |

| Others8 | 0.5% |

| Coca-Cola FEMSA | 65% | |

|---|---|---|

| FEMSA Comercio: | ||

| Retail Division | 28% | |

| Fuel Division | 1% | |

| Health Division | 4% | |

| Others8 | 2% |

![]() Retail Division

Retail Division ![]() Health Division

Health Division ![]() Fuel Division

Fuel Division

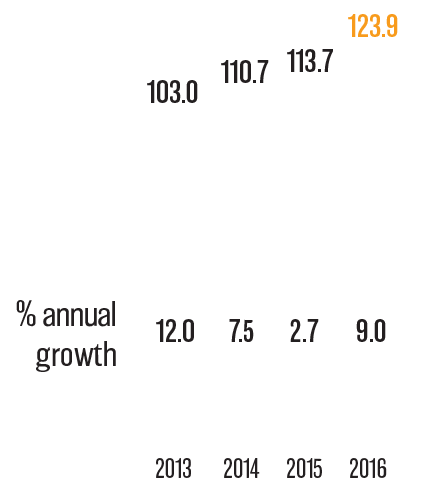

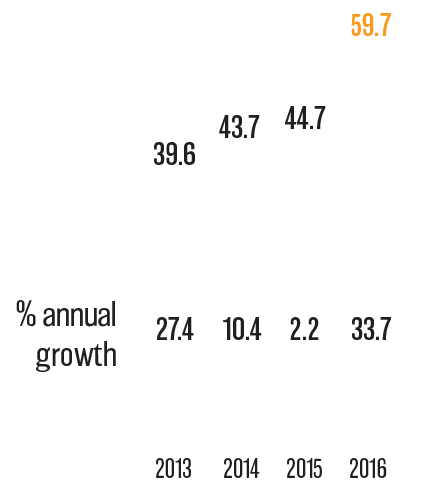

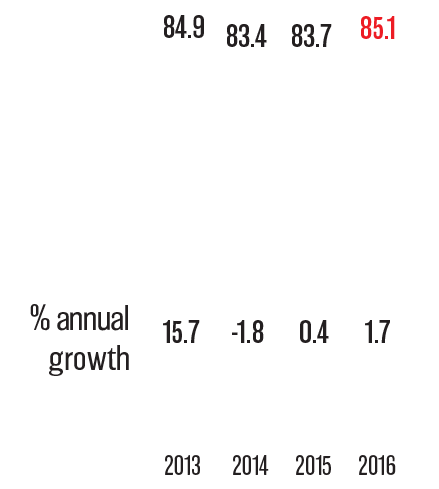

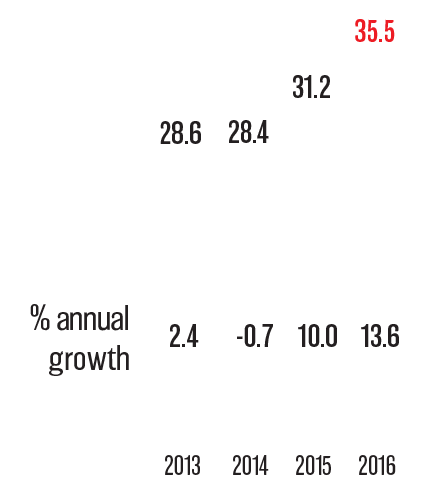

Headcount

thousands

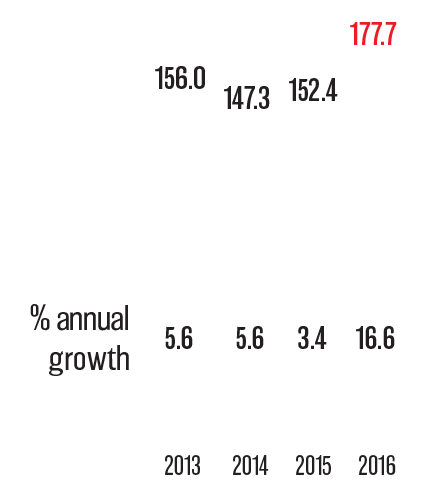

Total Revenues

billions of Mexican pesos

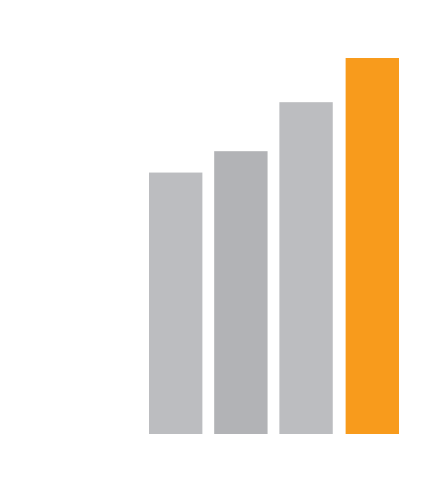

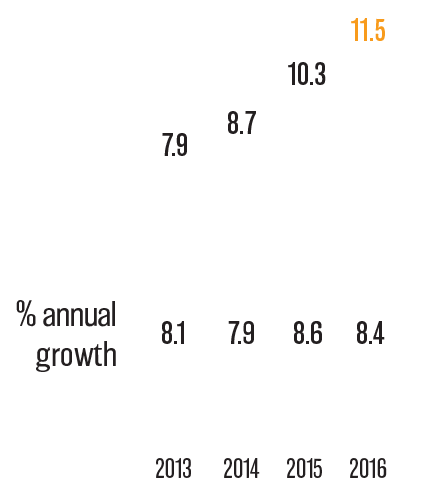

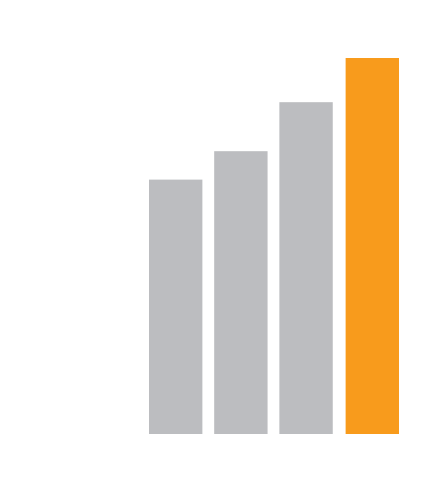

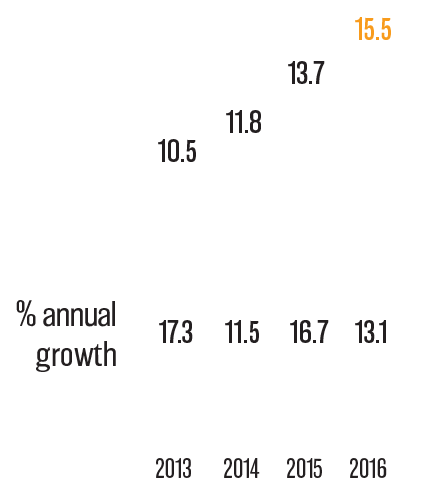

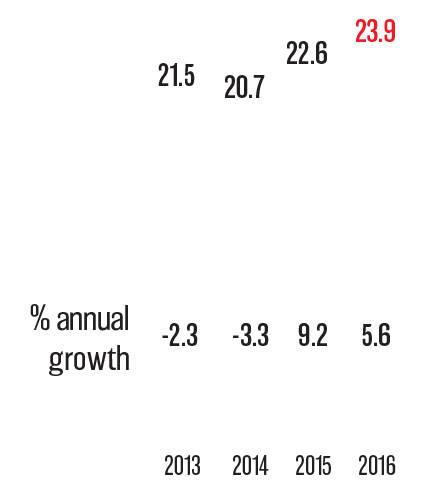

Income from Operations1

billions of Mexican pesos

EBITDA2

billions of Mexican pesos

Total Assets

billions of Mexican pesos

Headcount

thousands

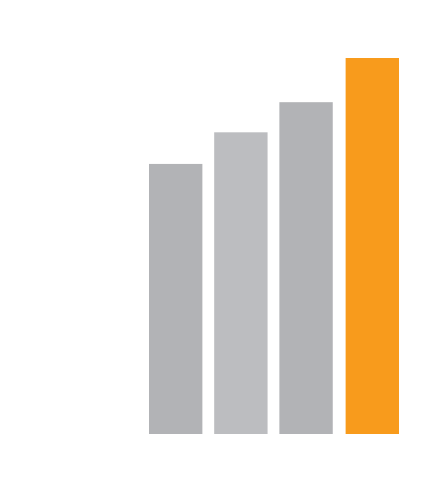

Total Revenues

billions of Mexican pesos

Income from Operations1

billions of Mexican pesos

EBITDA2

billions of Mexican pesos

Total Assets

billions of Mexican pesos

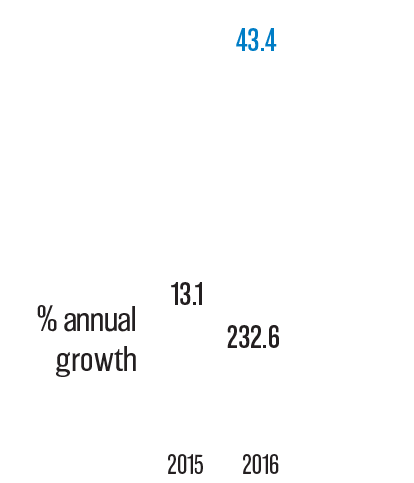

Headcount

thousands

Total Revenues

billions of Mexican pesos

Income from Operations1

billions of Mexican pesos

EBITDA2

billions of Mexican pesos

Total Assets

billions of Mexican pesos

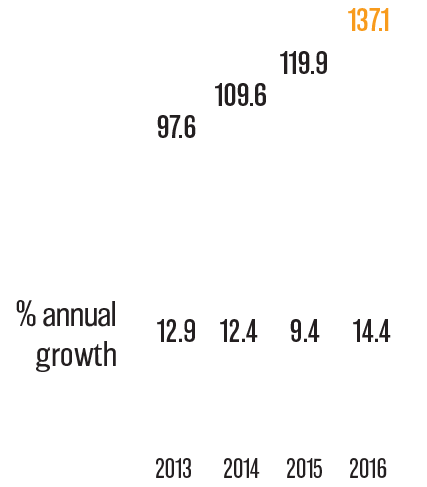

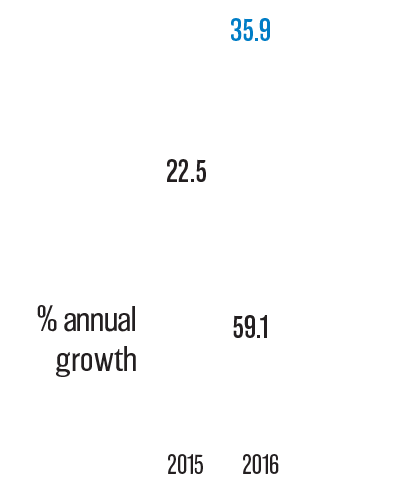

Headcount3

thousands

Total Revenues

billions of Mexican pesos

Income from Operations1

billions of Mexican pesos

EBITDA2

billions of Mexican pesos

Total Assets

billions of Mexican pesos