Retail Division

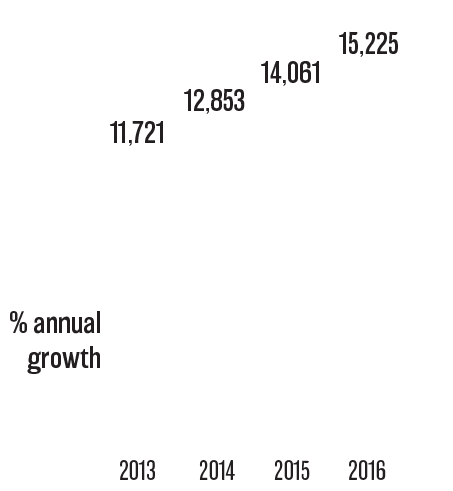

The OXXO chain of convenience stores in Mexico is the heart of our Retail Division. With approximately 11 million people making purchases each day, and a new store opening every eight hours on average, OXXO is today the third largest retailer in the country by revenue, and the leading retailer in Latin America by units.

We use proprietary models to identify optimal store locations, layouts and product categories, with strict cost of capital parameters that together with our well-developed operating processes and practices, allow us to drive margins and returns. We continue to fine-tune our business model by adding new categories and services in order to meet differentiated consumer needs, adjusting the value proposition of each store to its location and environment. This helped OXXO’s same-store sales in 2016 rise by an average of 7.0% over a demanding comparison base from the prior year.

2016 highlights:

net new OXXO stores in 2016

Health Division

We first entered the drugstore segment in 2013 with the acquisition of two regional chains in Mexico, leveraging our small-box retail expertise with the addition of pharmaceutical, health and beauty products. Two additional acquisitions in 2015, including a majority stake in Chilean leader Socofar, significantly advanced our growth strategy in this segment and allowed us to expand beyond our home market in Mexico. Given its expansion and continued potential for growth, as well as our commitment to transparent disclosure practices that align with internal decision-making, we now present all our drugstore and related operations under the Health Division.

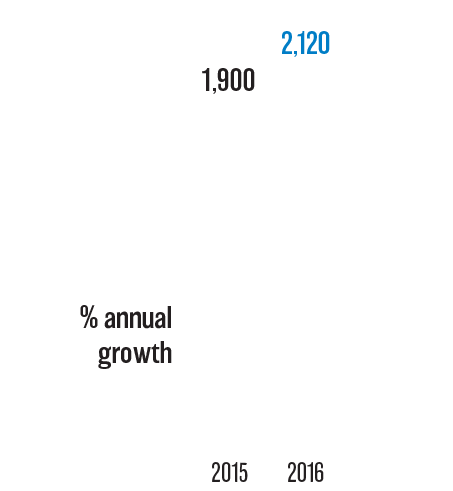

Our strategy is to consolidate fragmented markets such as Mexico and Colombia following the OXXO game plan, using our operational and logistics expertise to facilitate international expansion. With 2,120 stores at year-end 2016, we are becoming a key drugstore operator in Latin America. Revenues jumped a remarkable 232.6% in 2016 with the integration of Socofar, and 24.0% on an organic basis.

2016 highlights:

net new stores in 2016

We are preparing for further growth while integrating our legacy operations into a single platform.”

Fuel Division

When Mexico’s regulatory framework for the energy sector was modified in 2013, we saw a unique opportunity to participate in the transformation of the fuel industry via the operation of a large network of service stations. The clear alignment with our retail service operation and the ability to leverage OXXO’s brand equity, combined with the potential returns on capital of a low asset-intensity model, was compelling.

Our 382 strong network of OXXO GAS service stations is located in 16 states, primarily in the north of Mexico. Along with fuel, oil and additives, we differentiate our offering through reliable and high quality service, a strong brand, and exclusive promotions available only to OXXO GAS clients.

In our first full year of reporting Fuel Division results (2015: 10 months), total revenues increased 54.6% while same-station sales increased 7.6%. Looking ahead to 2017, as the industry continues to transition into an open market model, higher gas prices will likely translate to higher revenues but our long-term growth strategy will remain focused on expanding the network of service stations, and enhancing underlying profitability by continuing to gear the business model towards our expertise in retail dynamics.

2016 highlights:

We are expanding our infrastructure to accommodate rapid growth across more territories."

net new services stations in 2016