Leveraging our expertise in small-box retail

We entered the drugstore segment in 2013 with the acquisitions of two regional chains in Mexico, Farmacias YZA and Farmacias FM Moderna, leveraging our consumer know-how and small-box retail expertise to enhance the FEMSA Comercio value proposition with the addition of pharmaceutical and health and beauty products.

We made an additional two acquisitions in 2015 to advance our growth strategy in this segment: Farmacon, which operates over 200 stores in Mexico, and a majority stake in Socofar, which operates over 640 Cruz Verde drugstores and 150 Maicao beauty stores in Chile, and 150 drugstores in Colombia. Combined with our Farmacias YZA and Farmacias FM Moderna units, we now operate more than 1,900 drugstores and beauty stores in our markets today, an almost 220% jump from 2014. We see this segment as an important driver of our capital allocation and international growth strategy, representing an opportunity to consolidate another fragmented industry adjacent to our core.

In the quick-service restaurant category, we hold a majority stake in Doña Tota, a regional chain with over 200 sites in Mexico and the United States that enjoys strong brand recognition in its territories.

A key growth driver

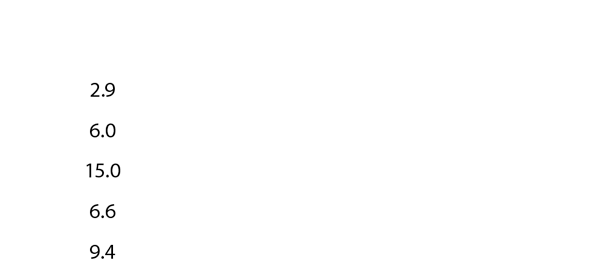

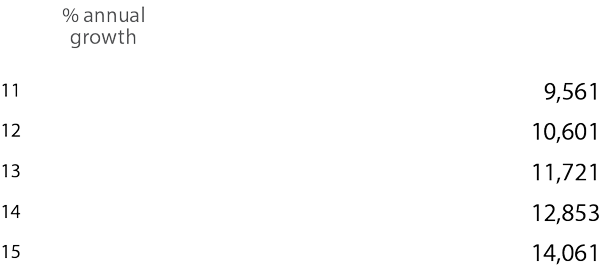

Growth at FEMSA Comercio’s Retail Division has been sustained and disciplined, outpacing the industry. It comprises a growing share of FEMSA’s total revenues and EBITDA, and while the operating and financial structure is changing as we add new formats and geographies, the benefits of scale and operating leverage ensure that continued expansion will drive long-term value.

2015 was another year of healthy growth, driven by new store openings, the acquisitions of Farmacon and Socofar, and continued improvement in Mexico’s consumption environment, particularly in the north of the country in parallel with the region’s manufacturing-driven economic gains, and in-store innovations.

Total revenues rose a strong 21.2% in 2015, to Ps. 132.9 billion. Organic revenues, which exclude non-comparable results from acquisitions made in the past twelve months, increased a solid 14.1%. Same store sales rose an average of 6.9% over 2014, driven by a 5.1% increase in average customer ticket and a 1.7% increase in store traffic.

Gross profit increased 20.1% year over year, while gross margin contracted by 30 percentage points to 35.6% primarily reflecting the integration of Socofar and Farmacon. Similarly, income from operations increased 25.6% to Ps. 10.9 billion, while the operating margin increased 30 percentage points.

2013

Drugstores are a new business

We acquired two drugstore chains in Mexico: Farmacias YZA the Yucatan based leader in the south eastern region of the country, and Farmacias FM Moderna, leader in Sinaloa, leveraging our expertise in small-box retail to develop new formats.